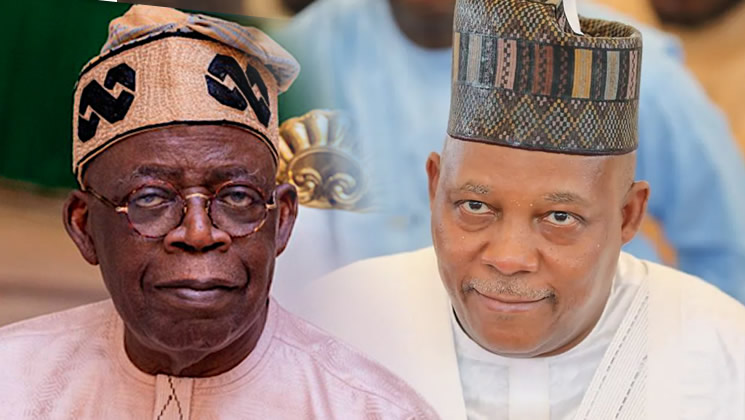

In their first 17 months in office, President Bola Tinubu and Vice President Kashim Shettima have embarked on extensive diplomatic missions, undertaking 41 trips across 23 countries and spending a total of 180 days abroad, which equates to six months. President Tinubu has particularly logged over 124 days visiting 16 countries on 29 trips, including key nations such as the United Kingdom, South Africa, and the United States. His engagements included multiple visits to cities like London and Riyadh, showcasing a focus on strengthening Nigeria’s international relationships. Vice President Shettima, meanwhile, has spent 56 days visiting 10 countries with a combined total of 12 trips, accumulating over 93 flight hours, but his travels yielded comparatively fewer results.

Despite their diplomatic efforts, a mixed outcome was recorded in terms of foreign direct investment (FDI). Data from the National Bureau of Statistics indicates that Nigeria did not attract any foreign capital from 11 of the countries visited by the leaders in the first half of 2024. Notable visits to nations such as Equatorial Guinea, Ethiopia, and Kenya yielded no economic benefits, raising questions about the efficacy of these foreign engagements. Shettima’s outreach to countries like Russia and Cuba similarly failed to generate capital inflow, exposing a gap between diplomatic activity and tangible financial returns for Nigeria.

In stark contrast to the lack of investment from certain countries, 12 other countries contributed significantly to Nigeria’s investment landscape, totaling $5.06 billion, reflecting a 201.7 percent increase from the previous year. Tinubu’s visits to countries like the United Kingdom and the Netherlands were particularly fruitful, bringing in a major share of this inflow—over $4.16 billion from countries visited exclusively by him. The UK stood out, with investment inflows jumping remarkably from $805.13 million to $2.93 billion. Conversely, investments from nations visited by Shettima contributed a modest $56.09 million, highlighting a disparity in the financial outcomes influenced by their respective engagements.

In terms of specific investments, the capital inflows from countries visited by both leaders demonstrated varied results. Although Kenya did not contribute to the FDI pool, South Africa’s investment surged significantly. However, the overall investment from the United States fell sharply, indicating complexities in the global investment dynamics. The Netherlands also shone amid this backdrop, reporting an impressive 901.7 percent increase in inflows, suggesting successful engagement strategies. Countries like Saudi Arabia and Germany also reported boosts in investments, reflecting a selective but promising return from select international engagements.

Financial implications of these diplomatic missions are notable, with substantial amounts spent on securing visas for both officials and their aides. An analysis by GovSpend highlighted that approximately N44.88 million was allocated to visa procurement in March 2024 alone, explicitly emphasizing the financial burden of maintaining international relations through travel. These expenses, especially focusing on long-term access to nations like the UK and France, underscore the costs associated with high-level diplomatic efforts. Critics, including civil society advocates and political figures, have voiced concerns about the necessity and economic justification of such international travels, suggesting a need for stricter accountability and prioritization of trips that offer genuine economic returns.

Despite claims of securing $30 billion in FDI commitments, evidence indicates a significant drop in actual foreign investment. Reports highlighted a staggering 65.33 percent decline in FDI, resulting from factors such as naira devaluation and instability in the foreign exchange market. The decline underscores broader challenges Nigeria faces in attracting long-term investments amid domestic and global economic uncertainties. Additionally, a majority of capital inflows comprised foreign currency loans and portfolio investments, which are typically perceived by investors as safer compared to direct equity investments. This trend signifies that while there may be immediate liquidity, the lack of stable, long-term investments could jeopardize future economic growth and infrastructure development in Nigeria, necessitating a reevaluation of engagement strategies and investment attraction mechanisms.