The impending abolition of the electronic transfer levy (E-Levy) is poised to mark a significant shift in Ghana’s fiscal policy under the newly elected administration of President John Dramani Mahama. Finance Minister-designate, Dr. Cassiel Ato Forson, has unequivocally stated that the controversial tax will be scrapped within the first 120 days of the Mahama presidency, aligning with a key campaign promise. This timeline sets the target date for the E-Levy’s removal at May 7, 2025. The levy, introduced by the previous government, has been a source of contention, with critics arguing it disproportionately affects lower-income earners and hampers digital financial transactions. The incoming administration views its elimination as a crucial step towards alleviating the financial burden on Ghanaians and fostering a more conducive economic environment.

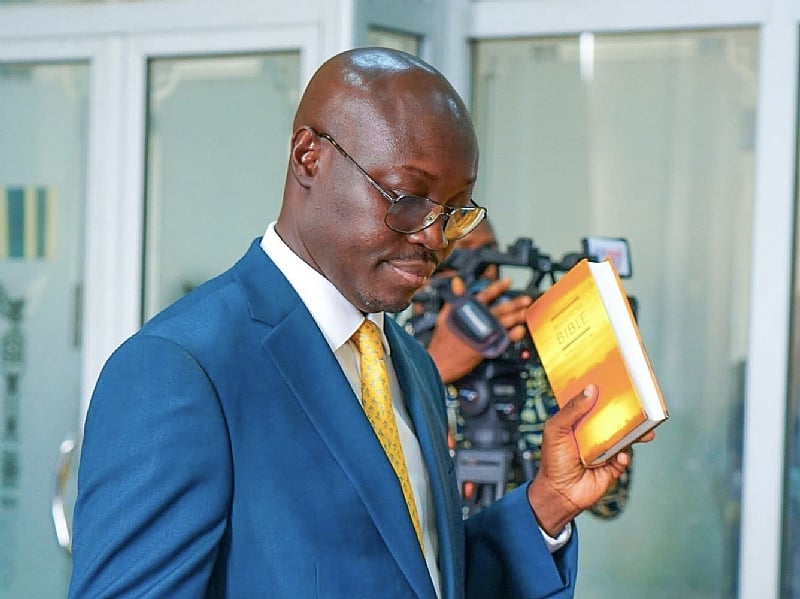

Dr. Forson’s assurances during his parliamentary vetting underscore the Mahama administration’s commitment to fulfilling its campaign pledges and prioritizing the economic well-being of its citizens. The E-Levy’s removal symbolizes a broader commitment to a more equitable and inclusive fiscal policy. The government’s intended approach centers on implementing alternative revenue generation strategies that do not impose additional taxes on the populace. This signifies a departure from the previous administration’s reliance on the E-Levy and signals a move towards more sustainable and less burdensome revenue-generating mechanisms.

The decision to scrap the E-Levy reflects President Mahama’s consistent criticism of the tax during his campaign. He characterized it as an unnecessary imposition on Ghanaians, arguing that it hindered economic activity and placed undue strain on individuals and businesses. By prioritizing its removal, the new administration aims to demonstrate its responsiveness to public concerns and its commitment to fostering a more favorable economic climate. The elimination of the E-Levy is expected to be a welcome relief for many Ghanaians, particularly those who rely heavily on digital transactions for their daily needs.

Dr. Forson emphasized the new administration’s focus on implementing revenue reforms that will not impose further taxes on citizens. This approach suggests a shift towards exploring alternative avenues for generating revenue, possibly including measures such as streamlining government spending, enhancing tax collection efficiency, and diversifying the economy to broaden the tax base. By avoiding additional taxes, the government aims to stimulate economic activity and empower individuals and businesses to thrive without the added burden of increased taxation. This strategy signifies a commitment to responsible fiscal management that prioritizes the economic welfare of the citizenry.

The commitment to abolish the E-Levy represents a substantial policy change with potential implications for both government revenue and the financial landscape of Ghana. The government will need to carefully consider and implement alternative revenue sources to offset the loss from the E-Levy. This will require a strategic approach to fiscal management, focusing on optimizing existing revenue streams and exploring innovative ways to generate income without further burdening the population. The successful implementation of alternative revenue measures will be crucial for maintaining fiscal stability and ensuring the government’s ability to fund essential services and development programs.

Looking ahead, the Mahama administration faces the task of not only eliminating the E-Levy but also implementing effective and sustainable revenue reforms. This will require a comprehensive and well-considered approach that balances the need for revenue generation with the imperative of promoting economic growth and alleviating the financial burden on citizens. The success of these reforms will be a key indicator of the government’s ability to deliver on its promises and build a stronger, more equitable economy for all Ghanaians. The focus on alternative revenue sources signifies a commitment to a more nuanced and citizen-centric approach to fiscal policy, one that prioritizes sustainable economic growth and the well-being of the population.