President Joseph Nyuma Boakai Sr. of Liberia launched two significant financial initiatives: the Central Bank of Liberia’s (CBL) Financial Education and Literacy Program and the Pan-African Payment & Settlement System (PAPSS). These programs are cornerstones of the government’s ARREST Agenda for Inclusive Development (AAID), aiming to boost financial inclusion and strengthen the nation’s economy. President Boakai emphasized the critical role of financial education in empowering individuals, particularly women and low-income communities, to manage finances effectively, establish businesses, and contribute to national economic development. He highlighted the positive trend in Liberia’s financial inclusion rate, which rose from 36% in 2017 to 52% in 2022, according to the World Bank. However, he also acknowledged the persistent gender gap in financial access, advocating for targeted financial education to address this disparity and ensure broader participation in the financial system.

The introduction of PAPSS marks a significant stride towards facilitating seamless cross-border trade within Africa. This innovative payment system allows for instant transactions in local currencies, aligning with the objectives of the African Continental Free Trade Area (AfCFTA). President Boakai underscored the potential of PAPSS to reduce reliance on foreign exchange, enhance economic stability, and support Liberia’s de-dollarization efforts. By enabling Liberian businesses to conduct transactions in their local currency across Africa, PAPSS promises to conserve foreign exchange reserves, strengthen the national currency, and foster economic resilience. The President urged widespread adoption of both the Financial Education Program and PAPSS by stakeholders, financial institutions, and businesses, recognizing their potential to drive economic empowerment, financial inclusion, and national development.

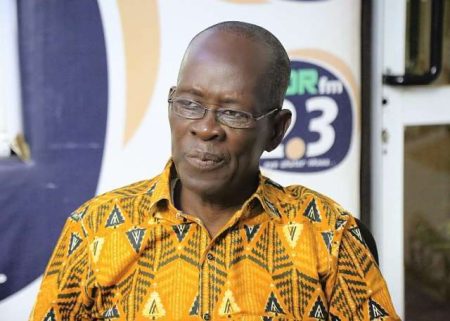

Finance and Development Planning Minister Augustine Kpehe Ngafuan addressed the inefficiencies and delays inherent in traditional financial transactions, characterizing them as hidden taxes that impede business growth. He emphasized the role of PAPSS, within the AfCFTA framework, in promoting regional economic integration and financial independence. CBL Executive Governor Henry F. Saamoi reiterated the Central Bank’s commitment to financial inclusion and digital transformation, positioning financial education and digital payment systems as crucial enablers of economic empowerment. He noted the significant growth in Liberia’s digital financial sector, evidenced by the increasing volume of mobile money transactions.

Liberia’s mobile money landscape has witnessed remarkable expansion, with transactions reaching L$471 billion in 2024, a substantial increase from L$421 billion in 2023. USD transactions via mobile money totaled $3.47 billion during the same period. Cross-border transactions, a key aspect of PAPSS functionality, experienced a significant 17.7% growth, reaching $494.5 million. With over 3 million active mobile money subscribers, digital payments have become the predominant mode of electronic transactions in Liberia, showcasing the country’s progress in embracing digital finance. This widespread adoption of mobile money lays a strong foundation for the successful integration of PAPSS and its potential to further revolutionize cross-border trade.

The launch of these initiatives was well-received by a diverse audience comprising government officials, financial sector stakeholders, development partners, and business community representatives, all pledging their support for successful implementation. The convergence of these groups signifies a collective commitment to leveraging financial education and innovative payment systems to drive economic growth and inclusion in Liberia. The launch event served as a platform to highlight the transformative potential of these initiatives and to solidify the collaborative efforts needed to realize their full impact. The overarching goal is to harness these tools to empower individuals, businesses, and the nation as a whole, paving the way for sustainable and inclusive economic development.

The combination of financial education and the implementation of PAPSS represents a comprehensive approach to strengthening Liberia’s financial landscape. By equipping individuals with the knowledge and skills to manage their finances effectively and providing a streamlined, efficient platform for cross-border transactions, these initiatives aim to foster economic empowerment and drive sustainable growth. The government’s commitment, coupled with the support of key stakeholders, positions Liberia to harness the full potential of these transformative programs and solidify its position within the evolving African economic landscape. The initiatives are anticipated to contribute significantly to achieving the goals outlined in the ARREST Agenda for Inclusive Development, promoting financial inclusion, and strengthening Liberia’s overall economic standing, ultimately benefiting all Liberians.