The Central Bank of Nigeria (CBN) implemented a revised ATM transaction fee structure on March 1, 2025, sparking controversy and concern among Nigerian citizens. The new policy dictates that while withdrawals from one’s own bank’s ATMs remain free, using another bank’s ATM incurs a N100 fee for transactions of N20,000 or less. This fee applies to on-site ATMs located within or near bank branches. Off-site ATMs, situated in locations like shopping malls and fuel stations, will impose an additional surcharge of up to N500. International withdrawals are subject to cost recovery, meaning users bear the international acquirer’s fee. The CBN clarified that even withdrawals below N20,000 from other banks’ ATMs still attract the N100 charge.

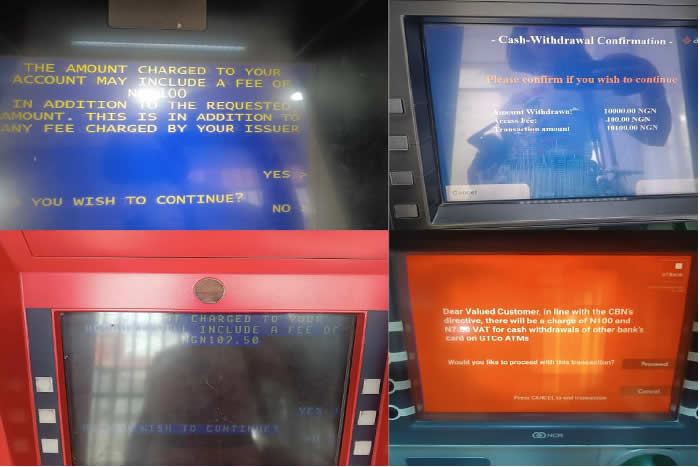

In anticipation of the new charges, banks across Lagos were observed loading their ATMs with cash, seemingly to discourage customers from using other banks’ machines. Several banks displayed notices informing customers of the N100 fee, with some providing detailed breakdowns including the additional 7.50 VAT. The readily available cash at various bank branches, each equipped with multiple ATMs, suggests a proactive approach by banks to retain customers and minimize the impact of the new charges on their own operations. This strategy, however, shifts the financial burden directly onto the consumer.

The new ATM charges have triggered widespread public outcry, with many Nigerians expressing frustration over the added financial burden. Citizens already grappling with increased costs of living, including higher data prices and other essential expenses, view the ATM fees as yet another strain on their limited resources. Some express the sentiment that the government and CBN are not adequately managing the financial system and are imposing undue hardship on the populace. The timing of the fee increase, amidst existing economic challenges, exacerbates public discontent.

Social media platforms have become a focal point for expressing dissatisfaction with the new policy. Users shared information about the charges, including emails from fintech companies explaining the fee structure. Concerns were raised about the cumulative effect of multiple banking charges, questioning the fairness of the system and its impact on already struggling Nigerians. Calls for new leadership and a reassessment of the CBN’s policies reflect the depth of public frustration. The fact that fintech companies, which have issued millions of cards but do not operate ATMs, do not benefit from these charges further fuels the perception of unfairness.

The CBN, in response to public concerns, has suggested several strategies to avoid the new charges. These include using only one’s own bank’s ATM, minimizing the use of off-site ATMs, and exploring alternative payment channels such as mobile apps and POS devices. While these suggestions offer some practical solutions, they do not address the underlying concerns about the overall cost burden on citizens. The onus is placed on individuals to navigate the complexities of the new fee structure, rather than on the system to provide more equitable solutions.

Opposition to the ATM charges has also come from organized labor and advocacy groups. The Trade Union Congress (TUC) has urged Nigerians to reject the “exploitative policy” and demand its immediate reversal. The TUC cited the cumulative effect of various economic hardships faced by Nigerians, including rising taxes, electricity tariffs, and communication costs. Concurrently, the Socio-Economic Rights and Accountability Project (SERAP) has called on President Tinubu to suspend the charges pending a court verdict on a lawsuit challenging the policy. These actions reflect a broader movement to challenge the perceived unfairness and economic burden of the new ATM fees.