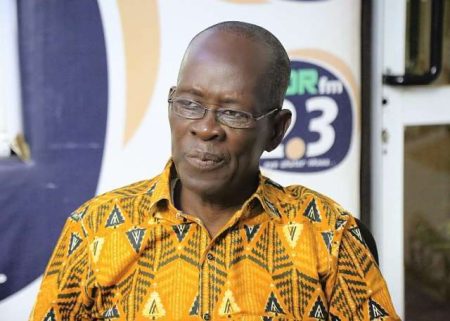

The Central Bank of Liberia (CBL) is embarking on a strategic initiative to diversify the nation’s reserves by incorporating gold, a move aimed at bolstering financial stability and reinforcing the bank’s operational independence. Executive Governor Henry F. Saamoi, during a meeting with US Embassy’s Chargé d’Affaires, Joseph E. Zadrozny, revealed that the CBL is conducting study tours in Ghana and Dubai to learn best practices in gold reserve management. This diversification strategy is crucial for enhancing resilience and fostering confidence in Liberia’s financial system. Governor Saamoi emphasized that this initiative not only strengthens the Liberian economy but also underscores the CBL’s autonomy, transparency, and accountability to the Liberian people. He stressed that the CBL’s independence is paramount and non-negotiable, forming the bedrock of sound monetary policy and sustainable economic growth.

The visit of Chargé d’Affaires Zadrozny reaffirmed the United States government’s continued support for Liberia’s economic development. He announced the resumption of technical assistance from the US Treasury’s Office of Technical Assistance (OTA) to the CBL, with a planned visit by the OTA scheduled for September. Further demonstrating this commitment, the US government will also provide renewed assistance to bolster Liberia’s insurance sector, including supporting the establishment of an independent Insurance Commission as the sole regulatory body for the sector. This collaborative effort underlines the shared focus on good governance and financial stability, key components of Liberia’s economic future.

The meeting between Governor Saamoi and Chargé d’Affaires Zadrozny reflected on the positive findings of a recent assessment by the Federal Reserve Bank of New York, which noted substantial progress in Liberia’s financial sector over the past three years. This progress underscores the effectiveness of ongoing reforms and initiatives within the CBL and the broader financial landscape. Governor Saamoi outlined other key priorities within the CBL’s strategic plan, including the implementation of the Liberia Payment and Interbank Settlement System and the development of a modern training center. These initiatives signify the CBL’s commitment to modernizing its operations and enhancing its capacity to effectively regulate and manage the financial sector.

The diversification of Liberia’s reserves through gold signifies a proactive approach to strengthening the nation’s financial standing. By incorporating gold into its reserve portfolio, the CBL aims to mitigate risks, enhance stability, and foster greater confidence in the Liberian economy. This strategic move aligns with international best practices in reserve management and reflects the CBL’s commitment to safeguarding the nation’s financial future. The emphasis on the CBL’s independence underscores the importance of maintaining autonomy in monetary policy decisions, free from external influence, ensuring that decisions are made in the best interest of the Liberian economy and its people.

The resumption of US technical assistance and the planned visit by the OTA will provide valuable support to the CBL in its ongoing efforts to strengthen its institutional capacity and implement key reforms. This collaboration will facilitate knowledge sharing, capacity building, and technical expertise, enabling the CBL to further enhance its regulatory framework and supervisory oversight. The support for the establishment of an independent Insurance Commission demonstrates a commitment to promoting transparency, accountability, and sound regulatory practices within the insurance sector, ultimately fostering greater confidence and stability within this crucial segment of the financial market.

This visit from Chargé d’Affaires Zadrozny solidifies the enduring partnership between the United States and Liberia, emphasizing a shared commitment to good governance, financial stability, and a diversified economic future. The collaboration between the two nations will contribute to strengthening Liberia’s financial institutions, promoting sustainable economic growth, and ultimately improving the lives of the Liberian people. The focus on diversifying Liberia’s economy reflects a forward-looking approach to development, ensuring resilience and adaptability in the face of global economic challenges.