The Imperative of Streamlining Bank Recapitalization in Nigeria: A Call for Technological Integration and Regulatory Predictability

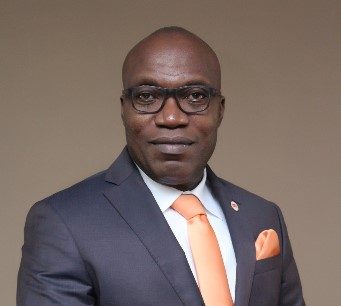

The Nigerian banking sector is undergoing a crucial recapitalization exercise orchestrated by the Central Bank of Nigeria (CBN). This initiative aims to strengthen the financial institutions and bolster the nation’s economic growth. However, the process has encountered a significant bottleneck in the verification of offers, creating concerns among investors and stakeholders. Johnson Chukwu, Group Managing Director of Cowry Assets Management Limited, has highlighted the urgency of leveraging technology and existing infrastructure like the Bank Verification Number (BVN) to expedite the verification process and restore investor confidence.

Chukwu’s appeal stems from the protracted delays experienced in concluding offers made by banks through public offerings and rights issues. Despite the passage of several months since the recapitalization directive, none of the offers have reached completion due to the CBN’s ongoing verification exercise. This delay, Chukwu argues, can be significantly mitigated by adopting readily available technology. Leveraging technology, particularly the BVN, would facilitate the swift acceptance or rejection of offers, enabling investors to promptly receive their allotments or redirect their funds to other profitable ventures.

The prolonged verification period has engendered apprehension among investors, particularly those whose funds may be returned in cases of oversubscription. The missed reinvestment opportunities represent a significant cost for these investors, further dampening their confidence in the process. Beyond the verification delays, Chukwu also points to the stringency of the CBN’s requirements for investors in bank shares. These requirements, including the provision of three-year audited financial statements, board resolutions authorizing investment, and tax clearance certificates, are seen as excessive barriers for both issuers and investors, potentially discouraging participation in the capital market.

While acknowledging the CBN’s crucial role in verifying the source of invested capital, Chukwu emphasizes the need for a balance between due diligence and efficiency. The protracted nature of the verification process not only erodes investor confidence but also sends negative signals to the broader financial market. A streamlined and transparent verification process is vital for attracting investment and ensuring the success of the recapitalization exercise.

The recapitalization of banks is not merely a regulatory exercise; it is a strategic imperative for strengthening the Nigerian banking sector and fostering economic growth. The capital market plays a pivotal role in this endeavor, providing a platform for banks to access much-needed capital and demonstrate their financial strength to investors. Successful Initial Public Offerings (IPOs), rights issues, and bond issuances signal financial stability and attract investor confidence, driving further investment and growth.

To maximize the effectiveness of the recapitalization process, Chukwu advocates for closer collaboration between the CBN and other regulatory bodies. This collaboration should focus on creating a more predictable regulatory environment, minimizing frequent policy changes that disrupt planning and introduce uncertainty for both banks and investors. Furthermore, banks should prioritize transparency and disclosure, publishing comprehensive financial statements, risk disclosures, and forward-looking guidance. By addressing the challenges of information asymmetry, regulatory uncertainty, and liquidity constraints, while simultaneously promoting transparency, corporate governance, and financial innovation, the Nigerian capital market can unlock substantial opportunities for bank recapitalization and drive sustainable economic growth.

The core of Chukwu’s argument rests on the need for a more efficient and investor-friendly recapitalization process. The current delays, stringent requirements, and unpredictable regulatory environment create significant hurdles for both issuers and investors. By embracing technology, streamlining the verification process, and fostering greater regulatory predictability, the CBN can significantly enhance the efficacy of the recapitalization exercise, bolster investor confidence, and strengthen the Nigerian banking sector. This, in turn, will contribute positively to the overall economic growth of the nation.

The protracted verification process, coupled with stringent investor requirements, creates an environment of uncertainty and apprehension, potentially deterring much-needed investment in the banking sector. The delays in concluding offers not only tie up investor funds but also lead to missed reinvestment opportunities, further eroding investor confidence. The CBN’s stringent requirements, while intended to ensure the integrity of the process, create significant barriers for both issuers and investors, potentially discouraging participation in the capital market. A more balanced approach, combining due diligence with efficiency, is crucial for attracting investment and ensuring the success of the recapitalization exercise.

The call for a more predictable regulatory environment underscores the importance of stability and consistency in policy-making. Frequent regulatory changes create uncertainty and disrupt planning for both banks and investors, increasing operational and regulatory risks. A stable and transparent regulatory framework is essential for fostering investor confidence and attracting long-term capital. Furthermore, increased transparency and disclosure by banks, through detailed financial reporting and forward-looking guidance, can help bridge the information gap between issuers and investors, further enhancing market efficiency and investor confidence.

The successful recapitalization of banks is not just about increasing their capital base; it is about strengthening the entire financial system and fostering economic growth. A robust banking sector is essential for channeling funds to productive investments, stimulating economic activity, and creating jobs. The current recapitalization exercise, if implemented effectively, can play a crucial role in strengthening the Nigerian banking sector and paving the way for sustainable economic development. However, addressing the challenges highlighted by Chukwu is essential for unlocking the full potential of this exercise.

The delays in the verification process are not merely a procedural issue; they represent a significant obstacle to achieving the objectives of the recapitalization exercise. The longer the delays persist, the greater the risk of eroding investor confidence and deterring much-needed investment. The CBN’s use of technology and the BVN can significantly expedite the verification process, ensuring timely completion of offers and restoring investor confidence.

The need for a more balanced approach to investor requirements is equally crucial. While maintaining due diligence is essential, overly stringent requirements can create unnecessary barriers for investors, discouraging participation in the capital market. A more pragmatic approach, balancing due diligence with investor accessibility, would facilitate greater participation and contribute to the success of the recapitalization exercise.

A predictable regulatory environment is a cornerstone of a healthy financial system. Frequent and unpredictable regulatory changes create uncertainty and disrupt planning for both banks and investors, increasing operational and regulatory risks. A stable and transparent regulatory framework is essential for fostering investor confidence and attracting long-term capital.

Increased transparency and disclosure by banks are crucial for building trust and enhancing investor confidence. By providing comprehensive financial information, risk disclosures, and forward-looking guidance, banks can bridge the information gap with investors, facilitating informed decision-making and attracting investment.

The successful recapitalization of banks is not merely a regulatory exercise; it is a strategic imperative for strengthening the Nigerian financial system and driving economic growth. By addressing the challenges of verification delays, stringent investor requirements, and regulatory uncertainty, while promoting transparency and disclosure, the Nigerian capital market can unlock substantial opportunities for bank recapitalization and pave the way for sustainable economic development.