Liberia’s commercial banking sector is experiencing a severe and escalating decline, posing a significant threat to the nation’s economic recovery and the Boakai-Koung administration’s development agenda. Key indicators of banking sector health, including total assets, bank capital, deposits, and credit to the economy, have all registered consecutive annual declines between 2022 and 2024. This decline, while initiated during the previous administration, has accelerated significantly under the current government, raising serious concerns about the administration’s economic policies and its commitment to reform. The alarming trend underscores deep-seated institutional vulnerabilities and a lack of effective policy responses to address the crisis. The situation demands immediate and decisive action to avert further deterioration and stabilize the financial system.

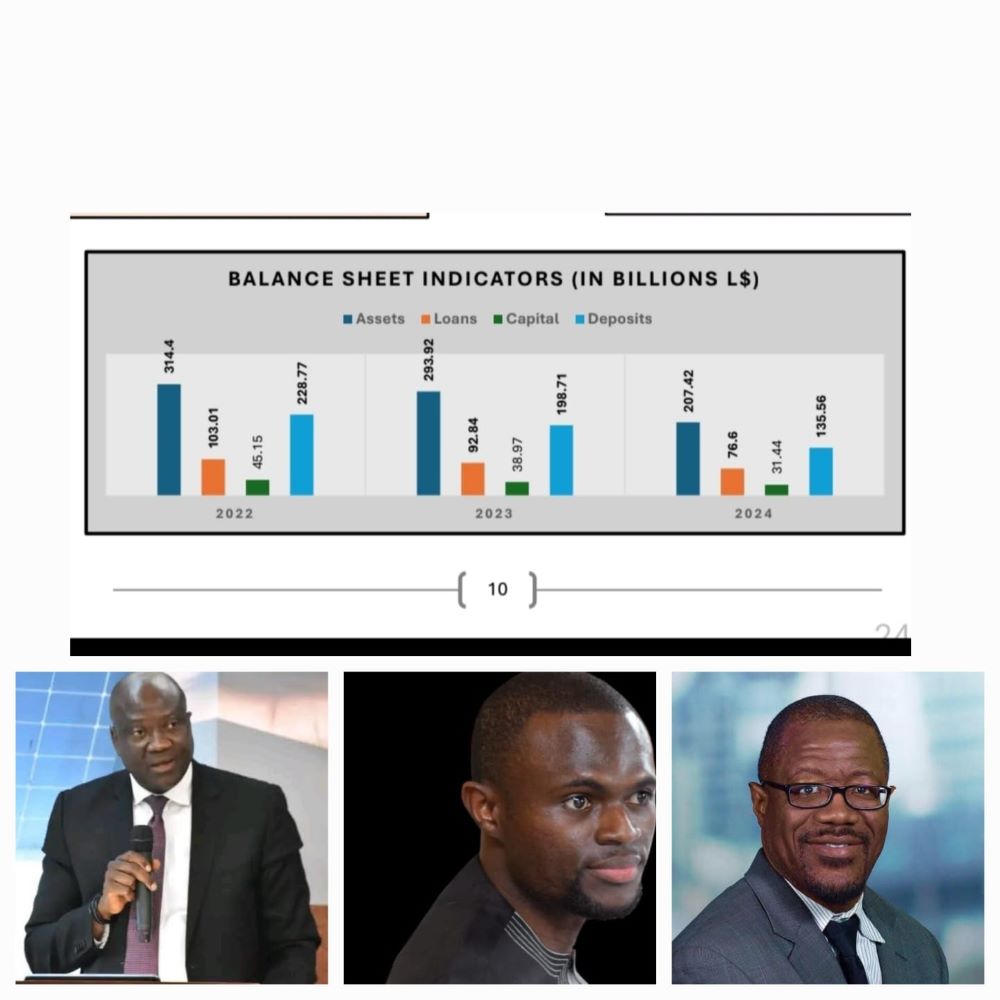

The magnitude of the decline is starkly evident in the reported figures. Total assets held by commercial banks plummeted by a staggering 34% from L$314.4 billion in 2022 to L$207.42 billion in 2024. This drastic reduction in assets limits the banks’ capacity to lend and support economic activities. Similarly, bank capital, which serves as a crucial buffer against financial shocks, eroded by 30%, falling from L$45.15 billion to L$31.44 billion. This weakening of capital reserves makes the banking sector more vulnerable to external pressures and economic downturns. The decline in lending, a critical driver of investment, growth, and job creation, is equally concerning. Loans contracted by 26%, dropping from L$103.01 billion to L$76.6 billion. This contraction in credit availability stifles businesses and hinders economic expansion. Furthermore, customer deposits, a barometer of public trust in the banking system, plunged by a dramatic 41%, from L$228.77 billion to L$135.56 billion, signaling a significant erosion of confidence in the financial sector.

The acceleration of the decline under the current administration is particularly troubling. The drop in total bank assets between 2023 and 2024 was L$86.5 billion, more than four times the decline witnessed between 2022 and 2023. This alarming acceleration is mirrored in other key indicators, including deposits and credit, highlighting the deepening crisis under the current government. The decline in deposits under the Boakai administration was more than double the previous year’s loss, and the contraction in credit also surpassed the previous year’s decrease. This rapid deterioration raises questions about the effectiveness of the administration’s economic policies and its ability to manage the financial sector. The lack of a robust and urgent policy response to the crisis further exacerbates concerns about the government’s commitment to stabilizing the banking sector and promoting economic recovery.

The implications of this shrinking banking sector are far-reaching and pose a serious threat to Liberia’s development aspirations. A weakened banking system hinders the government’s ability to mobilize domestic capital, limiting its capacity to finance development projects and stimulate economic growth. The reduced access to credit for small and medium-sized enterprises (SMEs) is particularly damaging, as these businesses are vital engines of job creation and economic diversification. The decline in lending to SMEs stifles their growth potential, hindering job creation and impeding poverty reduction efforts. This contradicts the core promises of the administration’s ARREST Agenda for Inclusive Development (AAID), which prioritizes private sector expansion as a key driver of economic growth. The current state of the banking sector is clearly incompatible with the AAID’s objectives and undermines the government’s ability to achieve its development goals.

While the administration commissioned an audit of the Central Bank in early 2024, which revealed widespread financial mismanagement and governance lapses, the subsequent actions have been inadequate. The audit, which resulted in an adverse opinion, a rare and serious verdict in public sector financial auditing, called for urgent executive and legislative action to address the identified weaknesses. However, instead of using the audit findings as a catalyst for reform and accountability, the administration reportedly rewarded implicated officials with substantial exit benefits, while retaining mid-level managers potentially involved in the mismanagement. This lack of accountability and decisive action undermines public trust and reinforces the perception that the government is more tolerant of failure than committed to reform.

Reversing the decline in the banking sector requires immediate and decisive action from both the Central Bank and the Ministry of Finance. Regulatory reforms must be enforced to ensure compliance with capital adequacy requirements, risk management controls, and sound governance standards. Restoring public trust and confidence in the banking system is paramount. This requires transparency, accountability, and demonstrable commitment to addressing the underlying issues that have led to the current crisis. A credible response must prioritize restoring the functionality and attractiveness of the banking system to micro, small, and medium-sized enterprises (MSMEs), which are crucial for economic growth and job creation. This could involve implementing a credit stimulus facility to de-risk lending to MSMEs through strategic partnerships between the Central Bank, the Ministry of Finance, and commercial banks.

Furthermore, investing in digital banking infrastructure and modernizing transaction systems can make banking more efficient and responsive to the needs of small businesses. A national banking literacy campaign, targeting entrepreneurs and informal sector actors, can build trust and encourage greater utilization of banking services. These initiatives must be accompanied by safeguards to prevent elite capture and ensure that benefits flow to productive enterprises, rather than being exploited for political gain. The government must recognize the urgency of the situation and act decisively to address the decline in the banking sector. Continued inaction will have severe consequences for the economy, including falling investor confidence, reduced access to credit, rising unemployment, and deepening poverty. The Boakai-Koung administration still has the opportunity to implement effective policies and reforms, but the window for action is closing rapidly.