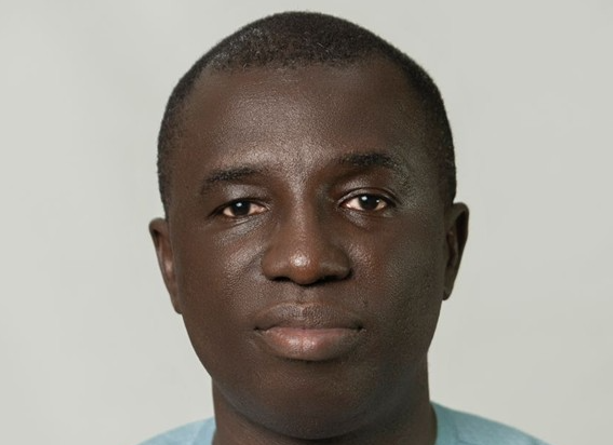

The Ghanaian government’s decision to abolish the minimum capital requirement for foreign investors has ignited a debate on the potential ramifications for the nation’s economy. While the move aims to attract greater foreign direct investment (FDI), concerns have been raised about the potential displacement of local businesses, particularly in sectors like retail and services, where they have traditionally held a strong presence. Economist and legal expert Appiah Kusi Adomako argues that a complete removal of this safeguard, implemented through the Ghana Investment Promotion Centre (GIPC) Act, could expose vulnerable sectors to unfair competition from well-capitalized foreign entities. He advocates for a more nuanced approach that considers the specific needs and characteristics of different sectors, ensuring a balance between attracting FDI and protecting local enterprises.

Adomako acknowledges the positive aspects of attracting FDI, recognizing Ghana’s growing appeal as an investment destination in West Africa. However, he cautions against prioritizing foreign investment at the expense of local businesses. The minimum capital requirement has historically served as a protective barrier, preventing smaller Ghanaian businesses from being overwhelmed by larger, more financially robust foreign competitors. A complete removal of this requirement, he argues, risks undermining the growth and sustainability of local businesses, potentially leading to their displacement and a weakening of the domestic economy. This could have long-term negative implications, hindering the development of local industries and entrepreneurship.

The core of Adomako’s argument centers on the need for a sector-specific approach to regulating foreign investment. This strategy involves assessing each sector individually and tailoring regulations to its unique circumstances. In sectors where Ghanaian businesses possess sufficient capital and technical expertise, such as retail trade, maintaining a minimum capital requirement would provide continued protection against foreign competition. Conversely, in sectors where domestic capacity is lacking, like advanced manufacturing or technology-driven industries, relaxing or removing the requirement could attract foreign investment and expertise, fostering growth and innovation. This targeted approach allows for a more strategic allocation of resources and ensures that regulations are aligned with the specific needs of each sector.

The proposed sector-by-sector approach offers a balanced solution, promoting both foreign investment and local business development. By identifying sectors where local businesses are strong and require protection, the government can maintain a level playing field and ensure their continued growth. Simultaneously, by easing restrictions in sectors where foreign expertise and capital are needed, the country can attract investment and stimulate innovation. This targeted approach ensures that foreign investment complements, rather than displaces, local businesses, creating a synergistic relationship that benefits the overall economy.

This debate highlights the complex interplay between attracting FDI and fostering local business growth. While FDI can bring much-needed capital, technology, and expertise, it must be managed carefully to avoid negative impacts on domestic industries. Adomako’s call for a sector-specific approach emphasizes the importance of tailoring regulations to the unique characteristics of each industry. This nuanced approach allows for a more strategic and effective regulation of foreign investment, maximizing its benefits while mitigating potential risks to local businesses. The government’s challenge lies in finding the right balance between attracting foreign investment and creating a supportive environment for local entrepreneurship, ensuring the long-term health and sustainability of the Ghanaian economy.

Ultimately, the goal is to create a win-win scenario where foreign investment and local businesses can thrive together, contributing to national development. The proposed sector-specific approach offers a viable pathway towards achieving this objective, allowing for targeted interventions that protect existing industries while attracting investment in areas where it is most needed. This strategy recognizes that FDI is not an end in itself, but a tool that should be leveraged strategically to support broader economic development goals. By carefully considering the needs of each sector, the government can create a regulatory environment that fosters both foreign investment and local business growth, leading to a more robust and resilient economy.