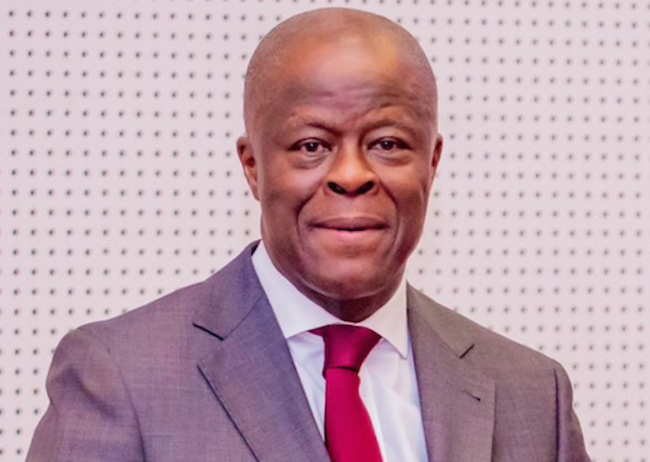

On October 31, 2024, the Federal Government of Nigeria will launch a nine-month program designed to allow individuals to deposit dollar bills that are held outside the formal banking system. This initiative comes in response to ongoing inflationary pressures on commodities, which are primarily influenced by fluctuations in the foreign exchange rate due to varying demand and supply dynamics. The announcement was made by the Minister of Finance and Coordinating Minister of the Economy, Wale Edun, following the 144th meeting of the National Economic Council, chaired by Vice President Kashim Shettima. This effort aims to facilitate the integration of informal dollar holdings into the regulated financial system, addressing the broader economic challenges related to currency exchange rates.

The key feature of this program is that individuals will not face penalties, taxes, or scrutiny when depositing their cash, as long as the funds are not linked to criminal activities. Edun emphasized that the only requirement for participants is to comply with the standard Know-Your-Customer (KYC) protocols as mandated by banks. By enabling individuals to bring their cash into the formal economy without fear of repercussions, the government hopes to promote financial transparency and accountability while reducing the risks associated with holding cash outside the banking system.

The rationale behind this initiative stems from the recognition that much of the informal cash circulation represents wealth that remains untapped within the economy. Edun noted that much of this currency is “unsafe, insecure, and outside legal limits,” which poses risks not only to individuals but to the overall economic framework. By encouraging the deposit of these funds, the government aims to ensure that dollar reserves within the economy increase. These additional reserves would potentially stabilize the foreign exchange rate, providing a needed buffer against inflation and enhancing the overall economic climate.

Guidelines for the execution of this program will first be issued by the Ministry of Finance, followed by specific directives from the Central Bank of Nigeria. This phased approach suggests a carefully considered process to ensure compliance and effective integration into the financial system. Furthermore, this initiative is seen as an opportunity for law-abiding citizens to formalize their cash holdings, thereby contributing to the country’s legal economic activities and providing a necessary outlet for those who wish to comply with existing laws and regulations.

In addition to this program, Edun provided insights into the government’s ongoing social protection initiatives, highlighting that 25 million Nigerians have benefited from federal efforts aimed at economic relief. These initiatives encompass a range of support mechanisms including digital outreach, microenterprise loans, and targeted assistance across sectors such as agriculture, health, manufacturing, and energy. This multifaceted approach illustrates the government’s commitment to addressing the economic challenges faced by its citizens while also encouraging the formalization of cash reserves.

Overall, this program represents a strategic move by the Nigerian government to harness informal dollar holdings within the economy, potentially bolstering its dollar reserves and stabilizing the foreign exchange market. By prioritizing compliance and presenting a clear path for individuals to integrate their cash, the initiative exemplifies an effort to improve economic conditions while providing citizens a means to protect and utilize their financial resources effectively and legally.