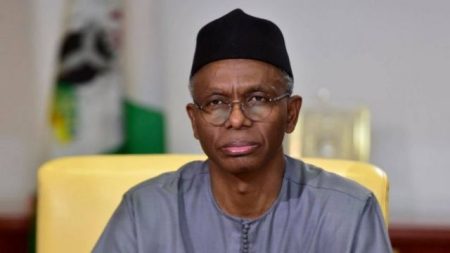

The Federal Mortgage Bank of Nigeria (FMBN) has achieved a significant financial turnaround, recording an operational surplus of N11.58 billion in its 2024 management accounts. This marks the first time in over three decades that the institution has achieved such a feat. The remarkable achievement is attributed to a multifaceted approach implemented by the current executive management, focusing on strategic financial management, cost efficiency measures, and robust revenue growth. The bank’s Managing Director/Chief Executive, Shehu Osidi, announced this milestone during a press conference commemorating the first anniversary of the current leadership. He highlighted the organization-wide improved discipline, which fostered better resource utilization and contributed to the positive financial outcome. However, Osidi cautioned that the surplus figure is preliminary and subject to adjustments after accounting for impairment considerations, particularly addressing the high non-performing loans inherited by the current management.

Despite the positive development of the operational surplus, the FMBN recognizes the pressing need for recapitalization. The current capital base of N2.5 billion is deemed grossly insufficient to effectively execute the bank’s mandate of providing affordable housing finance. The management has prioritized securing a N500 billion capital injection, with N250 billion expected from the Federal Government and the remainder to be sourced through debt capital. This recapitalization effort, coupled with the achieved operational surplus, signifies a determined effort to strengthen the bank’s financial standing and expand its capacity to deliver on its core mandate. This financial strengthening is crucial for the bank’s long-term sustainability and its ability to contribute meaningfully to addressing the housing deficit in Nigeria.

Further demonstrating improved financial performance, the FMBN reported a N3 billion increase in National Housing Fund (NHF) contributions in 2024, reaching a total of N103 billion. This growth reflects renewed confidence in the NHF scheme among Nigerian workers. The return of Kano State civil servants to the scheme after a 24-year absence is expected to further boost contributions in 2025, demonstrating the impact of targeted engagement with key stakeholders. In addition to increased contributions, the FMBN has significantly ramped up its loan approvals, reaching N71.5 billion in 2024 compared to N39.7 billion in the previous year. This substantial increase points to the bank’s proactive efforts in facilitating access to affordable housing finance. Furthermore, the bank disbursed N14.4 billion in refunds to 44,333 beneficiaries, demonstrating its commitment to efficient fund management and timely disbursement to eligible contributors.

The FMBN is also actively involved in the Renewed Hope Housing Programme, a key initiative of President Bola Ahmed Tinubu’s administration aimed at addressing the nation’s housing deficit. The bank is providing a substantial N100 billion off-takers’ guarantee for housing projects across the country, demonstrating its commitment to supporting large-scale housing development. In addition, the bank is providing direct funding of N19.9 billion for a housing project in Karsana, Abuja, and a N27 billion facility for another project in Ibeju Lekki, Lagos, showcasing its strategic allocation of resources to impactful housing initiatives. These investments underscore the FMBN’s significant role in the national housing agenda and its commitment to partnering with both public and private sectors to deliver affordable housing solutions.

Beyond financial performance, the FMBN has made significant strides in enhancing its operational efficiency. The deployment of a core banking application (CBA), a project that had been delayed for years, is nearing completion. The majority of transactions are now conducted through the CBA, with full implementation expected by March 31, 2025, followed by a six-month maintenance phase. This technological upgrade is expected to streamline operations, improve transparency, and enhance service delivery, laying the groundwork for a more modern and efficient banking system. This modernization is crucial for the bank to effectively manage its growing portfolio and improve customer experience.

Tackling the challenge of non-performing loans (NPLs) remains a priority for the FMBN. The bank has recovered N10.9 billion in bad loans through dedicated recovery teams, supplemented by an additional N3.1 billion recovered through regular channels. The bank has implemented stricter loan appraisal processes to enhance credit quality, minimize future defaults, and strengthen recovery mechanisms. These measures are crucial for ensuring the long-term financial health of the institution and safeguarding its resources. Furthermore, the FMBN has made significant progress in clearing a backlog of unaudited financial statements, with the 2018-2021 accounts now approved by the Central Bank of Nigeria. This underscores the management’s commitment to transparency and accountability, fostering greater trust and confidence in the institution. Looking forward, the FMBN is actively pursuing strategic partnerships, including a potential collaboration with Shelter Afrique Development Bank to finance student hostel accommodation schemes, further diversifying its portfolio and expanding its reach in addressing specific housing needs within the Nigerian market. This proactive approach to partnerships and collaborations demonstrates the bank’s commitment to exploring innovative solutions to address the multifaceted challenges of housing provision in Nigeria.