The Ghanaian Cedi’s Exchange Rate Dynamics: A Detailed Analysis

The Ghanaian Cedi’s exchange rate against major international currencies has experienced a period of relative stability following a recent appreciation trend. As of June 5, 2025, data compiled from Cedirates.com and other sources reveals a nuanced picture of the Cedi’s performance in various market segments, including forex bureaus, the interbank market, and money transfer platforms. The data indicates a slight depreciation against the US dollar, with average buying and selling rates of GHS10.10 and GHS10.92 per dollar, respectively. This suggests a marginal weakening of the Cedi compared to its recent gains.

A closer look at the forex bureau market reveals a wider spread between buying and selling rates. Individuals seeking to exchange US dollars for Cedis are offered a rate of GHS11.40, while those converting Cedis to dollars face a rate of GHS11.95. This difference reflects the margin charged by forex bureaus and highlights the variations in exchange rates across different market segments. The interbank market, where financial institutions trade currencies, presents a more competitive landscape. The Cedi’s buying and selling rates against the dollar stand at GHS10.22 and GHS10.24, respectively, indicating a narrower spread compared to the forex bureaus.

The Cedi’s performance against other major currencies, such as the British Pound and the Euro, also exhibits a degree of fluctuation. The average exchange rates for the Pound are GHS13.50 for buying Cedis with Pounds and GHS14.55 for selling Cedis to acquire Pounds. Similarly, the Euro trades at GHS11.41 for exchanging Euros for Cedis and GHS12.37 for the reverse transaction. On the Bank of Ghana’s interbank market, the Pound sells for GHS13.89, while the Euro trades at GHS11.69. These figures underscore the influence of market dynamics on the Cedi’s exchange rate across different currencies.

Money transfer platforms, which have become increasingly popular for remittances and cross-border transactions, offer competitive exchange rates. LemFi and Hurupay provide rates of GHS10.16 and GHS10.20 per dollar, respectively, for transfers from the US or the UK to Ghana. For Pound-to-Cedi transfers, LemFi offers a rate of GHS13.70, while Afriex provides a rate of GHS14.56. Euro-to-Cedi transfers are facilitated by Afriex at GHS12.25 and LemFi at GHS11.54. These rates further diversify the exchange rate landscape and provide consumers with options for conducting international transactions.

Digital subscription payments, a significant aspect of modern online consumption, also utilize specific exchange rates. Visa and Mastercard transactions for services like Netflix, Spotify, and Apple Music are processed at rates of GHS11.02 and GHS11.00 per dollar, respectively. These rates reflect the fees and charges associated with international card transactions and contribute to the overall complexity of the Cedi’s exchange rate dynamics.

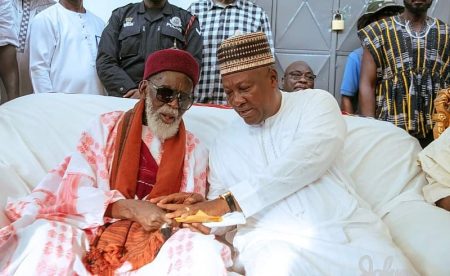

The recent stabilization of the Cedi’s exchange rate follows a period of appreciation, prompting government intervention to ensure a balanced approach. President John Dramani Mahama emphasized the importance of maintaining a realistic exchange rate range of GHS10 to GHS12 per dollar. While acknowledging the benefits of a strengthening Cedi, the President cautioned against excessive appreciation, which could negatively impact Ghana’s export competitiveness. He highlighted the collaborative efforts of the Bank of Ghana and the Ministry of Finance to achieve a stable exchange rate that supports both imports and exports.

This intervention underscores the government’s commitment to managing the Cedi’s exchange rate within a sustainable range. By striving for a balanced approach, the government aims to promote economic stability and avoid potential adverse effects on key sectors such as exports. The collaboration between the central bank and the finance ministry signals a coordinated effort to navigate the complexities of the foreign exchange market and maintain a stable currency environment.

The interplay of market forces, government policies, and the diverse range of exchange rate providers creates a dynamic landscape for the Ghanaian Cedi. Understanding the nuances of these different market segments is crucial for individuals and businesses engaged in international transactions. By monitoring the exchange rates offered by forex bureaus, banks, money transfer platforms, and digital payment processors, stakeholders can make informed decisions and optimize their cross-border financial activities.

The stability of the Cedi’s exchange rate is essential for maintaining economic balance and fostering international trade. The government’s efforts to manage the currency’s performance within a realistic range reflect a commitment to supporting both imports and exports. By carefully monitoring market trends and implementing appropriate policies, the authorities aim to create a stable and predictable environment for businesses and consumers alike. The Cedi’s exchange rate will continue to be a focal point of economic discussion and policymaking in the coming months.

The diverse range of exchange rates available in the Ghanaian market highlights the importance of comparing options and selecting the most favorable rates for specific transactions. Individuals and businesses can benefit from exploring different platforms and providers to minimize costs and maximize value. The availability of information through platforms like Cedirates.com empowers consumers and businesses to make informed decisions about their foreign exchange transactions.

The government’s focus on maintaining a balanced exchange rate reflects a broader economic strategy aimed at promoting stability and growth. By mitigating excessive fluctuations and fostering a predictable currency environment, the authorities aim to create a conducive atmosphere for investment and economic activity. The collaboration between the Bank of Ghana and the Ministry of Finance underscores the importance of coordinated policymaking in managing the complex dynamics of the foreign exchange market.

The Ghanaian Cedi’s exchange rate continues to be a significant factor in the country’s economic landscape. By understanding the various market segments, the influences on exchange rates, and the government’s role in managing currency fluctuations, individuals and businesses can navigate the complexities of international transactions and contribute to a stable and prosperous economic environment.