The Ghanaian cedi experienced a depreciation against the United States dollar on Tuesday, February 4, 2025, continuing a trend of fluctuating exchange rates. The buying rate of the dollar stood at GHS15.23, meaning it cost GHS15.23 to purchase one US dollar, while the selling rate was GHS15.72, implying that individuals converting cedis to dollars received GHS15.72 for each dollar. This represents a slight dip compared to the previous day’s rates, with the buying rate decreasing by 3 pesewas and the selling rate by 4 pesewas. These figures highlight the dynamic nature of currency markets and the constant fluctuations influenced by various economic factors.

Forex bureaus, which provide alternative currency exchange services, offered slightly different rates. Individuals exchanging cedis for dollars at forex bureaus received GHS15.50 for each dollar, while those converting dollars to cedis paid GHS15.90 for each dollar. This variance between forex bureau rates and the broader market is typical, reflecting the competitive nature of the currency exchange landscape and the specific operational costs of these businesses. The data for these exchange rates was sourced from Cedirates.com, a recognized platform in Ghana that provides updates on currency and fuel prices, adding credibility to the reported figures.

The interbank market, where financial institutions trade currencies amongst themselves, presented another perspective on the cedi’s performance. The buying rate for dollars on the interbank market was GHS15.29, and the selling rate was GHS15.31. These figures are typically more stable than those seen at forex bureaus or across the broader market due to the larger volumes traded and the involvement of established financial institutions. This difference in rates emphasizes the tiered structure of currency markets and the varying access different players have to the best available rates.

Beyond the US dollar, the Ghanaian cedi also traded against other major currencies. The average exchange rate for the British Pound was GHS18.76 when converting pounds to cedis and GHS19.44 when converting cedis to pounds. Similarly, the Euro traded at GHS15.59 for exchanging euros into cedis and GHS16.25 for exchanging cedis into euros. These exchange rates reflect the relative strength of these currencies against the cedi and are subject to fluctuations based on international market dynamics and local economic conditions. The Bank of Ghana’s interbank rates for the Pound and Euro were GHS19.02 and GHS15.79, respectively, providing further insight into the official rates within the Ghanaian banking system.

Money transfer services, such as LemFi and Afriex, offered competitive rates for remittances from the US and the UK to Ghana. For dollar transfers, LemFi offered a rate of GHS15.25 per dollar, while Afriex provided a slightly better rate of GHS15.19 per dollar. For British Pound transfers, LemFi offered GHS18.80, and Afriex offered GHS19.09 per pound. For euro transfers, Afriex offered GHS15.83 per euro, and LemFi offered GHS15.64 per euro. These specialized services often provide more favorable exchange rates compared to traditional banks or forex bureaus, catering to the increasing demand for efficient and cost-effective international money transfers.

Digital subscription services like Netflix, Spotify, and Apple Music, when paid for using Visa and Mastercard, utilized different exchange rates. Visa transactions were processed at a rate of GHS16.53 per dollar, while Mastercard transactions were processed at a rate of GHS16.46 per dollar. This difference arises from the individual agreements these companies have with the payment processors and the associated fees and exchange rate margins they incorporate.

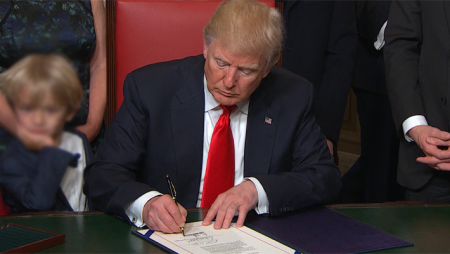

The fluctuations in the British Pound and Euro against the Ghanaian cedi, particularly within Ghanaian banks, are often attributed to a complex interplay of global economic forces. One prominent factor cited by experts is the impact of previous US economic policies, particularly those implemented during the administration of former President Donald Trump. Policies such as increased tariffs on goods from Canada, Mexico, and China had the effect of strengthening the US dollar relative to other currencies. These trade policies influenced global currency markets by creating shifts in demand for the US dollar and impacting the relative value of other currencies, including the Pound and the Euro. This demonstrates the interconnected nature of global economies and how policy decisions in one country can have ripple effects on currency markets worldwide.

The depreciation of the cedi against the dollar and other major currencies reflects the complex economic realities influencing Ghana’s financial landscape. Factors contributing to these fluctuations include international trade policies, global market sentiment, local economic conditions, and the supply and demand dynamics of the currency market itself. The varying exchange rates observed across different platforms, from forex bureaus to money transfer services and digital platforms, further highlight the multifaceted nature of currency exchange and the importance of staying informed about prevailing rates.

Understanding these variations in exchange rates is crucial for individuals and businesses engaged in international transactions or making cross-border payments. By consulting reliable sources like Cedirates.com and comparing rates offered by different providers, consumers and businesses can make informed decisions that minimize the impact of exchange rate fluctuations on their financial transactions. The ongoing monitoring of these rates and an understanding of the broader economic factors at play are essential for navigating the complexities of the currency exchange market.