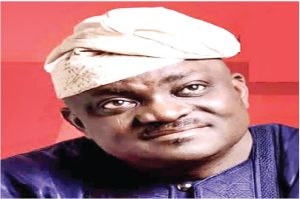

The Ghana Real Estate Developers Association (GREDA) has voiced its concerns regarding the stubbornly high prices of building materials in Ghana, despite the recent and sustained strengthening of the Ghanaian cedi against major international currencies. This unexpected price stagnation is creating a significant challenge for the real estate sector, which is a crucial driver of economic growth and a key player in addressing the nation’s housing deficit. GREDA argues that the benefits of the cedi’s appreciation should be passed on to consumers through lower prices for essential construction materials, but suppliers and manufacturers have yet to adjust their pricing strategies accordingly. The association’s president, Dr. James Orleans-Lindsay, has publicly called for economic patriotism, urging businesses involved in the construction supply chain to align their pricing with the improved currency exchange rates. He emphasizes that this price recalibration is vital for the success of the government’s economic recovery plan.

Dr. Orleans-Lindsay’s appeal for fair pricing hinges on the principle that a stronger cedi should translate into lower import costs for building materials. Given that many of these materials are sourced internationally, the previous cedi depreciation significantly impacted construction costs, contributing to higher property prices and exacerbating the housing affordability crisis. While the recent currency rebound was anticipated to alleviate these pressures, the continued high prices of materials like cement and iron rods suggest a disconnect between the exchange rate and market prices. GREDA contends that this disconnect is placing an undue burden on developers and ultimately on aspiring homeowners, who are still facing inflated housing costs despite the favorable currency fluctuations. The association argues that suppliers and manufacturers are unduly profiting from the situation by maintaining high prices while their import costs have decreased.

GREDA acknowledges its commitment to translating the benefits of the stronger cedi into more affordable housing for consumers. However, the association emphasizes the limitations it faces in fulfilling this commitment while the costs of essential building materials remain unchanged. Dr. Orleans-Lindsay pointed out the inherent contradiction in developers being expected to lower prices when their input costs remain high. This situation effectively squeezes developers’ profit margins, potentially hindering future investment in the sector. He underscored that developers are currently absorbing losses due to this price disparity, highlighting the urgency for suppliers and manufacturers to adjust their prices downwards and reflect the true economic situation. This, he argues, would create a more sustainable and equitable environment for all stakeholders in the housing market.

The real estate industry in Ghana has been grappling with the challenges of affordability for several years. The volatility of the cedi, coupled with high inflation rates, has significantly impacted the cost of construction, making homeownership a distant dream for many Ghanaians. The recent strengthening of the cedi offered a glimmer of hope for the sector, promising potential relief from escalating construction costs. However, GREDA’s observations indicate that this anticipated relief has yet to materialize, prompting their call for intervention to ensure that the benefits of the stronger currency are passed down the supply chain. The association’s concerns underscore the importance of a stable and predictable economic environment for the sustainable growth of the real estate sector.

Beyond the immediate concern of material pricing, GREDA also stresses the importance of maintaining exchange rate stability. Dr. Orleans-Lindsay argues that a consistently strong cedi is crucial for long-term planning and investment within the real estate sector. Predictable exchange rates allow developers to accurately forecast costs, manage risks, and make informed decisions regarding project timelines and budgets. The volatile nature of the cedi in recent years has created uncertainty in the market, making it challenging for developers to commit to large-scale projects. A stable currency, on the other hand, would foster investor confidence and encourage greater investment in the sector, ultimately contributing to the growth of the Ghanaian economy and addressing the persistent housing deficit.

In essence, GREDA’s appeal represents a call for transparency and fairness within the construction supply chain. The association argues that the current pricing practices of suppliers and manufacturers are incongruent with the prevailing economic reality of a strengthened cedi. By advocating for price adjustments that reflect the true cost of imported materials, GREDA aims to create a more level playing field for developers, promote affordability in the housing market, and foster sustainable growth within the real estate sector. The association’s emphasis on economic patriotism underscores the importance of collective responsibility in driving economic recovery and ensuring that the benefits of a strengthened currency are shared across the economy, ultimately contributing to national development and the well-being of Ghanaian citizens.