Paragraph 1: The Imperative of Tax Reform in Nigeria

Nigeria’s current tax system, characterized by outdated laws and a low tax-to-GDP ratio, is in dire need of reform. The country’s tax revenue collection significantly lags behind its African counterparts and pales in comparison to nations like South Africa. This shortfall in revenue generation severely hampers Nigeria’s ability to fund essential public services, invest in critical infrastructure, and stimulate economic growth. Recognizing this urgent need, the Nigerian government, under President Bola Tinubu, initiated a comprehensive tax reform process, culminating in the submission of a series of bills to the National Assembly. These bills aim to modernize the tax system, enhance revenue collection, and create a more equitable and efficient tax framework. The potential impact of these reforms, if implemented effectively, is substantial and could significantly transform the Nigerian economy.

Paragraph 2: Unveiling the Tax Reform Bills and Their Objectives

The proposed tax reform bills, encompassing the Nigerian Tax Bill, the Tax Administration Bill, the Revenue Tax Board Bill, and the Nigerian Revenue Service Establishment Bill, represent a concerted effort to overhaul the Nigerian tax landscape. The overarching goal of these bills is to align Nigeria’s tax system with international best practices, streamline tax administration, and broaden the tax base. The bills seek to achieve these objectives by updating archaic tax laws, introducing more efficient tax collection mechanisms, and addressing loopholes that have historically facilitated tax evasion. Furthermore, the reforms aim to create a more predictable and transparent tax environment, thereby fostering investor confidence and promoting economic stability.

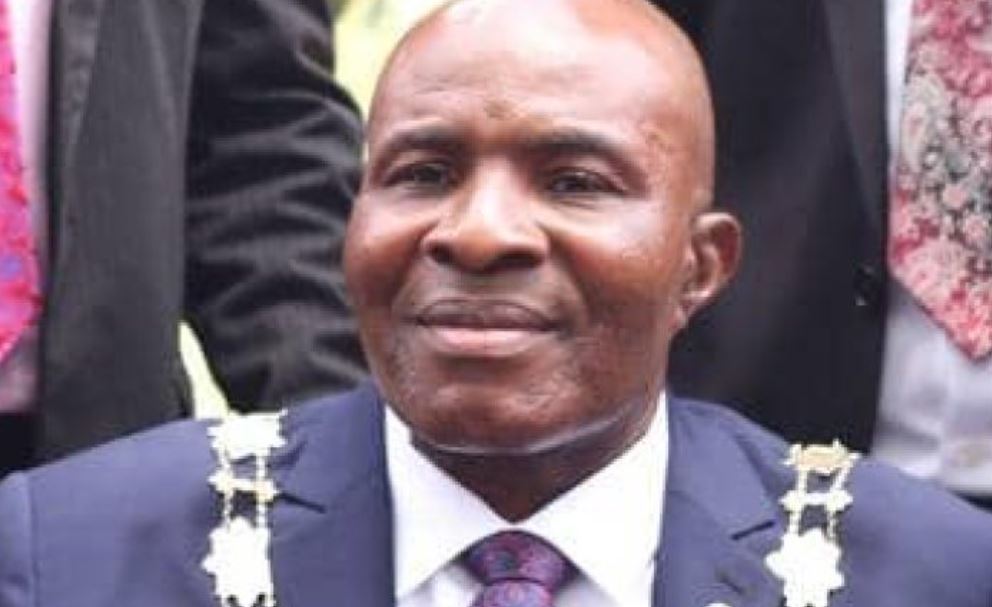

Paragraph 3: Expert Perspectives on the Transformative Potential of the Reforms

Leading figures in the Nigerian financial and economic landscape have expressed strong support for the proposed tax reforms, emphasizing their potential to revolutionize the Nigerian economy. Davidson Alaribe, the 60th president of the Institute of Chartered Accountants of Nigeria (ICAN), has hailed the reforms as a potential game-changer, asserting that their diligent implementation could significantly enhance revenue mobilization and positively influence consumption patterns. Similarly, Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, has highlighted the reforms’ capacity to stimulate economic growth while safeguarding the interests of low-income earners and small businesses. These endorsements underscore the widespread recognition of the reforms’ potential to reshape Nigeria’s economic trajectory.

Paragraph 4: Protecting Vulnerable Groups and Promoting Equitable Taxation

A key feature of the proposed tax reforms is their emphasis on protecting vulnerable segments of the population and promoting equitable taxation. The reforms aim to exempt low-income earners and small businesses from certain tax burdens, recognizing their vulnerability and the importance of fostering their growth. Simultaneously, the reforms seek to ensure that large businesses contribute their fair share to the national treasury by closing loopholes and streamlining tax administration processes. This balanced approach seeks to create a tax system that is both efficient and equitable, distributing the tax burden fairly across different income groups and business sizes.

Paragraph 5: Harmonizing Tax Laws and Simplifying Compliance

The tax reform bills also prioritize the harmonization of tax laws and the simplification of tax compliance procedures. This streamlining effort aims to reduce the complexity and administrative burden associated with tax compliance, making it easier for individuals and businesses to fulfill their tax obligations. By simplifying the tax system and making it more transparent, the reforms seek to encourage voluntary tax compliance and reduce the incidence of tax evasion. This, in turn, will contribute to a more stable and predictable revenue stream for the government.

Paragraph 6: Building Consensus and Fostering Collaboration for Successful Implementation

The successful implementation of the tax reforms hinges on building consensus among stakeholders and fostering collaboration between government agencies, businesses, and civil society organizations. Stakeholder engagement and public awareness campaigns are crucial to ensuring that the reforms are understood, accepted, and effectively implemented. By working together, stakeholders can create a tax system that is both efficient and equitable, contributing to sustainable economic growth and improving the lives of all Nigerians. The proposed tax reforms represent a critical step towards a more robust and sustainable fiscal future for Nigeria, paving the way for greater economic prosperity and improved public services.