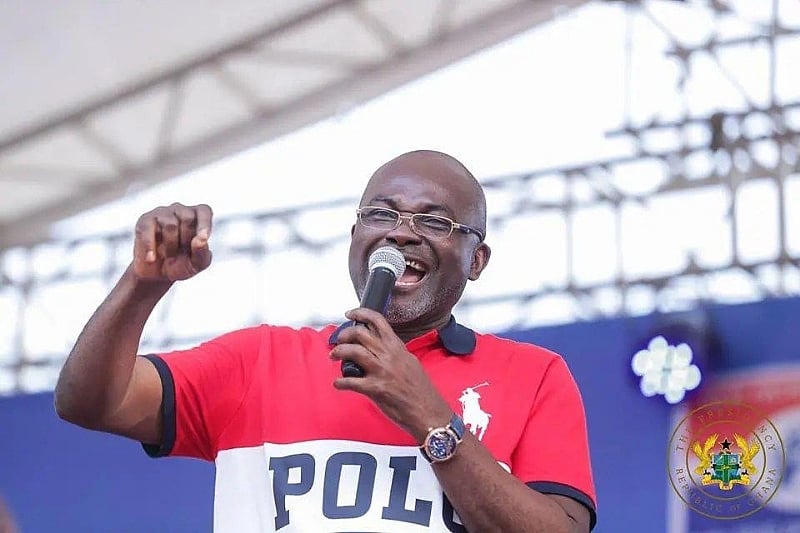

Kennedy Agyapong, a prominent Ghanaian businessman and former parliamentarian, has forcefully challenged the prevailing narrative attributing the recent appreciation of the Ghanaian cedi against the US dollar to government policies implemented by either the ruling New Patriotic Party (NPP) or the opposition National Democratic Congress (NDC). He contends that the current strengthening of the cedi is primarily driven by external global economic forces, specifically the ongoing trade tensions and economic rivalry between the United States and China, rather than any domestic policy interventions. Agyapong dismisses claims of political ingenuity behind the cedi’s resurgence, arguing that such assertions are misleading and lack a sound economic basis.

Agyapong’s central argument revolves around the impact of US trade policies, particularly those enacted under the Trump administration, on global currency markets. He posits that these policies have dampened international demand for the US dollar, leading to a surplus of the currency and a consequent depreciation in its value relative to other currencies, including the Ghanaian cedi. This decreased demand, he argues, is the primary driver behind the cedi’s recent gains. He suggests that the prevailing economic narrative within Ghana, which credits either the NPP or NDC for the currency’s improvement, is politically motivated and ignores the fundamental global economic dynamics at play.

Furthermore, Agyapong emphasizes the intensifying economic competition between the United States and China as a key factor contributing to the shift in global currency markets. As China’s economic influence expands, global markets are diversifying their currency holdings, reducing their reliance on the US dollar. This diversification, he claims, is further weakening the dollar and indirectly strengthening currencies like the cedi. He cautions against misinterpreting this externally driven phenomenon as a sign of successful domestic economic policy.

Agyapong’s argument underscores the interconnectedness of global financial markets and the influence of international economic trends on local currencies. He warns against attributing short-term fluctuations in exchange rates solely to domestic policies, emphasizing the need to consider the broader global economic context. He characterizes the current strengthening of the cedi as a transient phenomenon, driven by external factors that are beyond the control of any single government. He predicts that should the US and the rest of the world resolve their trade disputes and the global demand for the dollar rebounds, the cedi’s gains will likely be reversed.

Agyapong criticizes the tendency to politicize economic issues, particularly fluctuations in the exchange rate, and urges a more nuanced and realistic approach to understanding these complexities. He cautions against accepting at face value claims by politicians of influencing the exchange rate, emphasizing the importance of understanding fundamental economic principles. He stresses the need to differentiate between genuine economic improvements and temporary fluctuations caused by external factors. He encourages Ghanaians to approach economic discussions with a critical eye, recognizing the often intertwined nature of politics and economics.

Ultimately, Agyapong calls for greater economic literacy and a more informed public discourse on economic matters. He emphasizes the importance of understanding the underlying principles governing exchange rate fluctuations and cautions against being swayed by politically motivated interpretations. He advocates for a more data-driven and less politically charged analysis of economic trends, encouraging Ghanaians to be discerning consumers of economic information. His core message is that the recent appreciation of the cedi is not a consequence of domestic policy successes, but rather a reflection of broader global economic shifts, particularly the evolving dynamics of the US-China economic relationship.