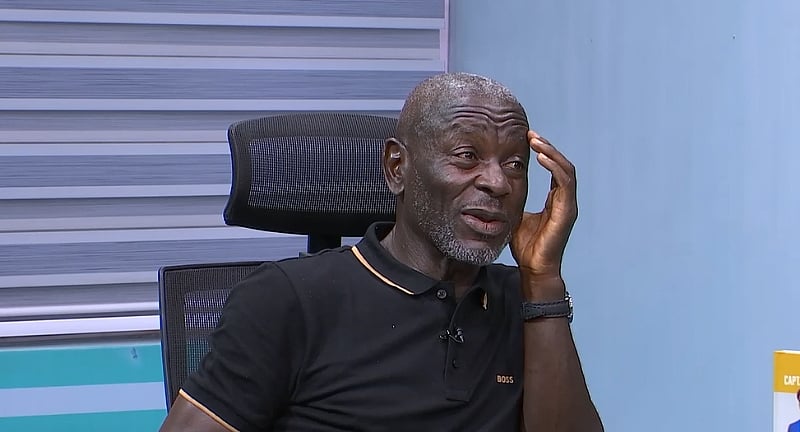

The collapse of UT Bank in 2017, a casualty of Ghana’s financial sector restructuring, left a trail of unpaid debts, a significant portion of which is still owed to the bank’s founder, Retired Captain Prince Kofi Amoabeng. Amoabeng, in a recent interview, expressed his profound disappointment with the behavior of numerous individuals and businesses who have failed to honor their loan obligations, despite his personal efforts to assist them in repayment. This pervasive defaulting behavior, coupled with internal mismanagement, has been identified as a major contributing factor to the bank’s demise, underscoring the critical need for robust loan recovery mechanisms and the ongoing struggle faced by financial institutions in ensuring borrower accountability.

Amoabeng’s frustration stems from the sheer number of defaulters and the scale of the outstanding debt. While he has managed to recover some of the owed funds, a substantial sum remains unrecovered, leaving him with significant financial losses. He recounted numerous instances where he personally intervened to help borrowers facing difficulties, offering flexible repayment plans and other forms of assistance. However, despite his efforts, a significant number of borrowers remained “incorrigible,” failing to meet their revised obligations and ultimately contributing to the bank’s downfall. His experience paints a concerning picture of a culture of loan defaulting that undermines the stability of the financial sector.

The narrative surrounding UT Bank’s collapse highlights a complex interplay of factors, including the prevailing economic conditions, internal management practices, and the behavior of borrowers. While the financial sector restructuring played a role, the high volume of non-performing loans, exacerbated by the defaulters’ unwillingness to repay, significantly weakened the bank’s financial position. This situation underscores the critical need for a robust regulatory framework that ensures stricter enforcement of loan agreements and promotes responsible borrowing practices. Strengthening the legal framework for debt recovery and enhancing the capacity of financial institutions to manage risk are crucial steps towards preventing similar occurrences in the future.

The case of UT Bank serves as a stark reminder of the interconnectedness of the financial ecosystem. The failure of borrowers to honor their obligations creates a domino effect, impacting not only the lending institution but also the broader economy. When a significant number of loans become non-performing, the bank’s ability to lend to other businesses and individuals is severely hampered, limiting economic growth and development. Moreover, the collapse of a financial institution can erode public confidence in the banking sector, further destabilizing the economy. Therefore, addressing the issue of loan defaults is not simply a matter of recovering individual debts; it is a vital step towards safeguarding the stability and integrity of the entire financial system.

The experience of Retired Captain Amoabeng underscores the importance of fostering a culture of financial responsibility among borrowers. Beyond the legal framework, promoting ethical lending and borrowing practices is crucial for a healthy financial sector. This includes educating borrowers about the implications of defaulting on loans and encouraging them to seek assistance from financial institutions when facing difficulties. Furthermore, financial institutions should prioritize responsible lending practices, ensuring that loans are granted to individuals and businesses with the capacity to repay. By promoting transparency and accountability on both sides of the lending transaction, we can create a more sustainable and resilient financial system.

In conclusion, the collapse of UT Bank and the subsequent struggle to recover outstanding debts serve as a cautionary tale about the fragility of the financial sector and the importance of responsible lending and borrowing practices. The experience of Retired Captain Amoabeng highlights the devastating impact of widespread loan defaults and the need for stricter enforcement of loan agreements. Addressing this issue requires a multi-pronged approach that includes strengthening the regulatory framework, enhancing risk management practices within financial institutions, and fostering a culture of financial responsibility among borrowers. By working together to create a more robust and ethical financial ecosystem, we can safeguard the stability of the economy and promote sustainable growth and development.