In a recent announcement, the Liberia Revenue Authority (LRA) has publicly expressed gratitude to taxpayers across the country for their continued commitment to fulfilling tax obligations, which are integral to the nation’s revenue collection goals. As of September 30, 2024, the LRA reported a collection of US$513.8 million, amounting to 74% of the projected domestic revenue target of US$694.4 million for the year. This figure represents a notable 12% increase from the previous fiscal year and exceeds the year-to-date revenue expectations by US$54.3 million, indicating a positive trend in domestic revenue mobilization.

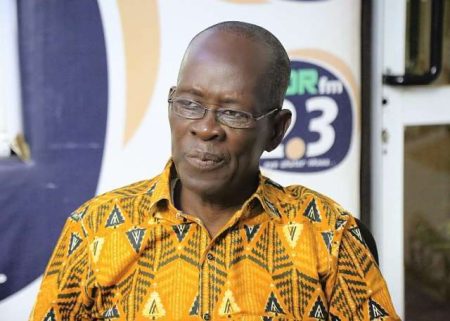

For the 2024 national budget, the LRA projects a total target of US$738.86 million, comprising US$696.4 million expected from domestic tax collections and an additional US$42.4 million from external sources, which have yet to materialize. This situation underscores the critical importance of domestic revenue generation, as all revenues collected to date are attributable to compliant taxpayers. Commissioner General James Dorbor Jallah has highlighted this reliance on local tax compliance, emphasizing the role of taxpayers in achieving the LRA’s budgetary and developmental goals.

With US$513.8 million already garnered against the pre-recast annual domestic revenue target of US$696.4 million, the LRA appears to be on the right track toward meeting its financial objectives for 2024. The progress seen under Commissioner General Jallah’s leadership points to a strategic and effective approach to revenue collection since he took office in March 2024. His tenure has thus far seen consistent monthly revenue collections that surpass those of the previous year, positioning the LRA to potentially reach the ambitious target of one billion dollars in the near future.

Gratitude is also extended by the LRA to its management team and employees, alongside various government ministries and agencies that contribute to the revenue collection efforts. This collaborative endeavor is geared towards enhancing the government’s capacity to invest in public services and infrastructure, aligning with the broader developmental agenda for Liberia. Commissioner Jallah has underscored the significance of these partnerships in solidifying fiscal strategies aimed at national improvement.

In light of recent negative propaganda and misinformation surrounding the LRA, Commissioner Jallah urged staff and stakeholders to maintain focus on their shared mission of increasing domestic revenue. He emphasized the importance of community cohesion and mutual trust against attempts to disrupt the essential work being done for the country. The call for vigilance includes a recommendation for verification of information through credible sources, aiding in strengthening the collective efforts towards fiscal success.

Looking forward, the LRA is committed to facilitating tax compliance by simplifying processes, maintaining operational transparency, and investing in digital initiatives that enhance the efficiency of tax payments while addressing revenue leakages. Furthermore, the Authority plans to bolster outreach and education initiatives to improve taxpayer awareness regarding obligations and their significant contributions to national development. As a celebration of taxpayer contributions, the LRA has also announced upcoming National Taxpayer Appreciation events in November, set to honor the nation’s most compliant and highest taxpayers for their essential roles in Liberia’s progress.