The Nigerian consumer goods sector is navigating a turbulent period, marked by significant price fluctuations and declining market capitalization across key segments like beverages, food products, and household durables. This downturn reflects a complex interplay of factors, potentially including economic headwinds, changing consumer preferences, and industry-specific challenges. The performance of individual companies within these sectors paints a picture of both resilience and vulnerability, with some managing to maintain their ground while others experience sharp declines. This volatility underscores the dynamic nature of the consumer goods market and the need for companies to adapt to shifting market dynamics.

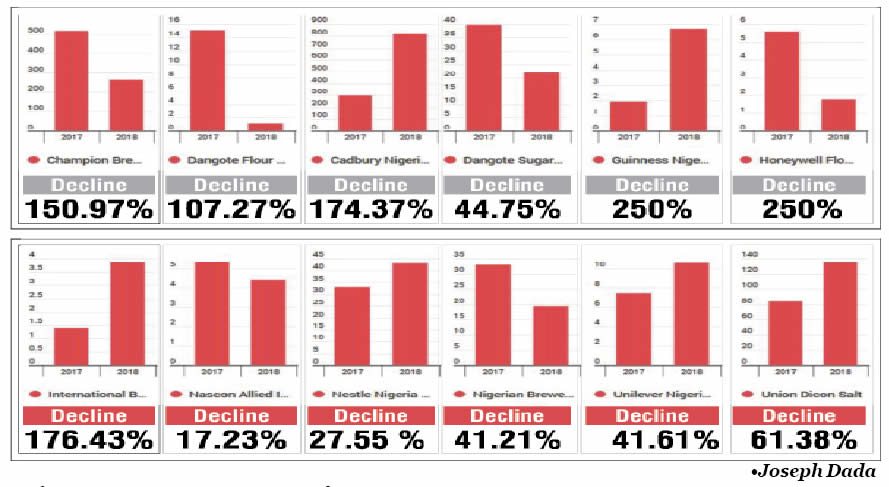

The beverage sector, a significant contributor to the Nigerian economy, has been particularly hard hit. Major players like Guinness Nigeria Plc and Nigerian Breweries have experienced substantial price drops, impacting their market capitalization and overall sector performance. Guinness Nigeria Plc witnessed a 35% decline in its share price, while Nigerian Breweries experienced a steeper fall of 69%. These declines, coupled with the stagnant performance of Golden Guinea Breweries and the price drop for International Breweries, suggest a broader trend of contraction within the beverage segment. The cumulative effect of these individual company performances has resulted in a decreased trading volume and a sense of uncertainty within the sector.

The food products sector presents a mixed bag, with some companies demonstrating resilience while others struggle to maintain their market position. BUA Foods Plc has managed to hold its price steady, showcasing stability in the face of market volatility. However, Dangote Sugar Refinery experienced a significant price drop of 230%, raising concerns about the factors impacting its performance. Honeywell Flour Mill also recorded a decline, albeit a less dramatic one. Nascon Allied Industries Plc stands out as a positive performer, achieving a price increase. This varied performance within the food products sector suggests the influence of company-specific factors, such as operational efficiency, product diversification, and market positioning, in determining individual success amidst broader market challenges.

The diversified food products sector, encompassing companies with a broader product portfolio, also reflects the overall market downturn. Cadbury Nigeria Plc and Nestle Nigeria Plc, both prominent players in this segment, experienced substantial price declines of 70% and 76% respectively. These declines significantly impact the overall market capitalization of the diversified food products sector, indicating the vulnerability of even established brands to prevailing market pressures. The decreased trading volume further underscores the cautious sentiment prevailing within this sector.

Despite the challenges faced by individual companies and sub-sectors, the combined market capitalization of the Nigerian beverage and food sectors remains substantial, reaching N10.84 trillion. This figure, while indicative of the overall size and importance of these sectors to the Nigerian economy, also masks the underlying volatility and individual company struggles. The substantial market capitalization serves as a reminder of the potential for growth and recovery, but also highlights the need for strategic adjustments and market responsiveness to navigate the current challenges.

The Nigerian consumer goods sector is at a critical juncture. While the overall market capitalization remains significant, the declining prices and reduced trading volumes across various sub-sectors signal a need for careful analysis and strategic action. Companies within the beverage, food products, and diversified food products sectors must adapt to changing market dynamics, consumer preferences, and economic pressures to regain lost ground and ensure sustainable growth. The performance of individual companies highlights the importance of factors such as operational efficiency, product diversification, and market positioning in navigating market volatility. The coming months will be crucial in determining the resilience and adaptability of the Nigerian consumer goods sector and its ability to overcome the current challenges and capitalize on future opportunities.