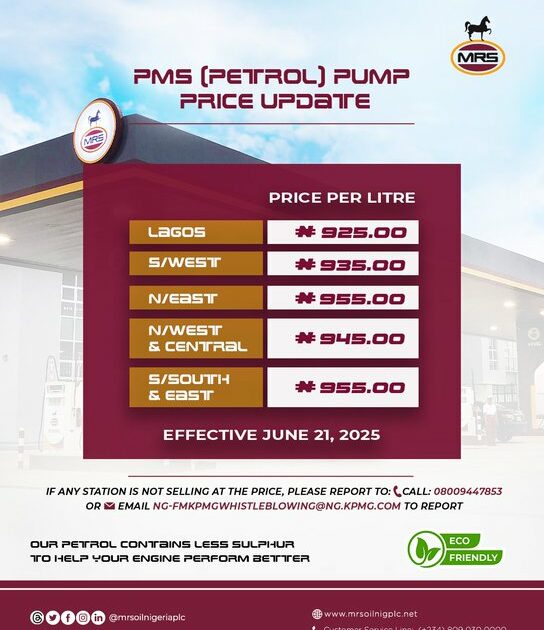

The Nigerian fuel market experienced a significant price hike in June 2025, with MRS Oil Nigeria Plc, a major distributor of Dangote refinery’s products, leading the charge. The company announced a nationwide increase in the pump price of Premium Motor Spirit (PMS), commonly known as petrol, effective June 21, 2025. This move followed an increase in the ex-depot price of petrol by the Dangote refinery from N825 to N880 per litre. The price adjustments varied across different regions of the country, reflecting the logistical costs associated with transporting the product.

In Lagos, the commercial hub of Nigeria, the pump price of petrol at MRS stations surged from N885 to N925 per litre. Other regions experienced similar increases, with the Southeast and Northeast bearing the highest prices at N955 per litre. Customers in Ogun, Oyo, Ondo, Osun, and Ekiti states faced a slightly lower price of N935 per litre, while those in the North West and North Central regions paid N945 per litre. MRS attributed the price adjustments to the increased ex-depot price, effectively passing the cost increase down to consumers. The company advised its customers to check for updated pump prices at various MRS stations nationwide.

This development sparked immediate concern and criticism from stakeholders, including labor unions and consumer protection groups. The President of the Petroleum and Natural Gas Senior Staff Association of Nigeria (PENGASSAN), Festus Osifo, accused oil marketers of exploiting Nigerians by inflating petrol prices. He argued that the prevailing pump prices were unjustified given the falling global crude oil prices. Osifo estimated that a fair pump price for petrol in Nigeria should be between N700 and N750 per litre, significantly lower than the prices announced by MRS and other marketers.

The price hike by MRS signaled a potential ripple effect across the downstream petroleum sector. Other major distributors of Dangote refinery’s products, such as Heyden and AP, were expected to follow suit and implement similar price adjustments. This anticipated price cascade threatened to further burden Nigerian consumers already grappling with the rising cost of living. The situation underlined the challenges of deregulation in the downstream sector and the need for effective regulatory mechanisms to protect consumers from arbitrary price increases.

Prior to the price hike by MRS, other importers had already increased their prices citing the rise in global crude oil prices. However, the argument made by PENGASSAN highlighted the disconnect between global crude oil prices, which were experiencing a downward trend, and the rising petrol prices in Nigeria. This discrepancy fueled suspicions of price manipulation and profiteering by oil marketers. The situation called for greater transparency in the pricing mechanism and more stringent regulatory oversight to ensure fair pricing for consumers.

The June 2025 petrol price hike by MRS Oil Nigeria Plc served as a microcosm of the complex dynamics in the Nigerian downstream petroleum sector. The interplay of factors such as ex-depot price adjustments, regional variations in pricing, accusations of price gouging, and the anticipated price cascade by other marketers underscored the challenges and vulnerabilities inherent in a deregulated market. The incident highlighted the pressing need for effective government intervention to balance the interests of oil marketers with the welfare of Nigerian consumers. The lack of a clear and consistent pricing framework, coupled with inadequate regulatory oversight, created an environment conducive to price volatility and potential exploitation of consumers. This situation called for urgent reforms to ensure a stable and equitable fuel market in Nigeria.