The National Insurance Commission (NAICOM) and the Office of the Head of the Civil Service of the Federation (OHCSF) recently collaborated to organize a workshop in Abuja focused on the Group Life Assurance Policy. This initiative aimed to clarify the policy’s provisions and implementation among stakeholders within government ministries, departments, and agencies (MDAs). The workshop underscores the importance of the policy in ensuring the welfare and financial security of public servants and their families, particularly within the context of the Contributory Pension Scheme. This proactive approach by NAICOM and OHCSF reflects the government’s commitment to enhancing employee well-being and financial protection.

The workshop’s central theme revolved around the revised guidelines for the Group Life Insurance Policy, jointly issued by NAICOM and the National Pension Commission (PenCom). These guidelines mandate that all employees enrolled in the Contributory Pension Scheme must be covered by a group life insurance policy for the duration of their employment. The legal basis for this mandate is enshrined in Section 4(5) of the Pension Reform Act of 2014, which stipulates that employers must maintain a group life insurance policy for each employee, equivalent to at least three times the employee’s annual total emoluments. The Act further specifies that premium payments must be made no later than the commencement date of the insurance coverage. The workshop served as a platform to disseminate this information and ensure comprehensive understanding among relevant stakeholders.

Mrs. Didi Walson-Jack, the Head of the Civil Service of the Federation, highlighted the significance of the policy in providing financial security for public servants and their families. Represented by Mrs. Patience Oyekunle, Permanent Secretary of the OHCSF, Walson-Jack commended President Bola Tinubu for renewing the annuity policy, a testament to the government’s commitment to employee welfare. She also lauded NAICOM for organizing the training, recognizing its importance in educating civil servants about the policy’s benefits and implementation. The workshop proceedings underscored the collaborative efforts between government agencies to ensure the effective implementation of the Group Life Assurance Policy.

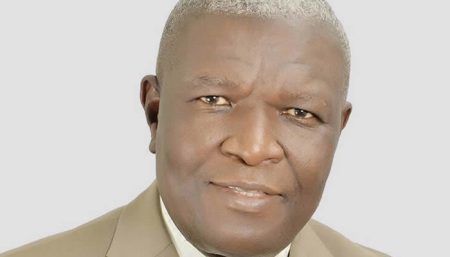

Mr. Olusegun Ayo Omosehin, the Commissioner for Insurance, represented by Mr. Ekerete Gam-Ikon, Deputy Commissioner for Finance and Administration, reinforced NAICOM’s commitment to transparent and accountable policy implementation. Omosehin expressed appreciation for the inter-agency collaboration and emphasized the importance of the workshop in equipping civil servants with the necessary knowledge and tools to effectively manage and benefit from the Group Life Assurance Policy. This collaborative approach ensures that the policy’s benefits reach the intended recipients and contribute to their overall financial well-being.

The workshop served as a crucial platform for disseminating information, clarifying policy provisions, and addressing any potential challenges related to the Group Life Assurance Policy. Participants gained valuable insights into the policy’s benefits, claims processes, and the roles and responsibilities of various stakeholders. The training also facilitated interaction and knowledge sharing among participants, fostering a better understanding of the policy’s practical implications. By empowering civil servants with the necessary knowledge, the workshop aimed to ensure the smooth and effective implementation of the policy across the federal civil service.

The workshop represents a significant milestone in strengthening the implementation of the Group Life Assurance Policy within the federal civil service. It underscores the government’s dedication to employee well-being and financial security, aligning with broader efforts to enhance the overall welfare of public servants. The collaboration between NAICOM and OHCSF, coupled with the active participation of MDAs, demonstrates a unified commitment to achieving the policy’s objectives. The workshop’s success serves as a model for future initiatives aimed at improving the welfare and financial security of public servants.