The Genesis of Modern Savings & Loans: A Vision for Empowering Liberian Businesses

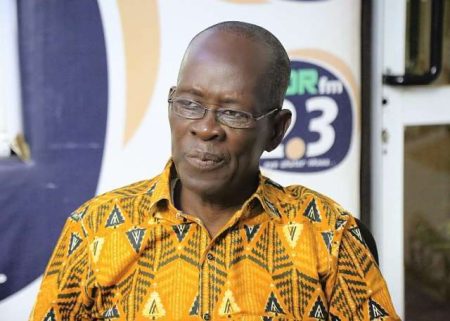

In 2014, amidst the backdrop of a developing nation striving for economic resurgence, Counsellor George B. Kailondo envisioned a financial institution that would empower Liberian businesses and individuals, fostering economic growth and prosperity. This vision materialized on Wednesday, May 7th, with the inauguration of the Modern Savings & Loans Microfinance Deposit-Taking Institution, a landmark moment in Liberia’s financial landscape. Former President Ellen Johnson Sirleaf, a staunch advocate for private sector development, officiated the ribbon-cutting ceremony, marking the institution’s official commencement of operations. This event signaled not just the opening of a new financial entity, but the dawn of a new era of accessible finance, poised to uplift Liberian entrepreneurs and drive economic progress.

A Catalyst for Economic Growth: Empowering Small Businesses and Individuals

The Modern Savings & Loans Microfinance Deposit-Taking Institution is strategically positioned to address a critical gap in Liberia’s financial ecosystem: access to affordable credit for small businesses and ordinary citizens. Recognizing the vital role of the private sector as the engine of economic growth and job creation, the institution aims to provide financial services tailored to the needs of local entrepreneurs and individuals, enabling them to invest, expand, and thrive. This focus on empowering the grassroots level of the economy is expected to have a ripple effect, stimulating economic activity and creating opportunities for wealth generation. The institution’s commitment to supporting small businesses aligns with the broader national goal of fostering economic self-reliance and reducing dependence on external aid.

A Departure from Traditional Lending: Lower Interest Rates and Accessible Credit

One of the key distinguishing features of the Modern Savings & Loans Microfinance Deposit-Taking Institution is its commitment to offering significantly lower interest rates compared to traditional banking institutions. With existing interest rates often exceeding 18 percent, posing a substantial barrier for businesses seeking capital, the institution’s pledge to reduce rates below 10 percent represents a paradigm shift in the Liberian financial landscape. This move is expected to make credit more accessible and affordable, fostering a more conducive environment for business growth and expansion. By alleviating the financial burden of high interest rates, the institution empowers entrepreneurs to invest more confidently in their ventures, fostering innovation and job creation.

Former President Sirleaf’s Endorsement: A Call for National Support

Former President Ellen Johnson Sirleaf’s presence at the inauguration ceremony underscored the significance of the Modern Savings & Loans Microfinance Deposit-Taking Institution in Liberia’s development trajectory. Praising Mr. Kailondo’s initiative as an exemplary act of giving back to the nation, she emphasized the crucial role of a robust private sector in driving economic growth and creating job opportunities. Drawing parallels with the rapid development witnessed in the West African subregion fueled by citizen-led investments, President Sirleaf urged Liberians to embrace and support the institution’s mission of empowering smaller businesses. Her endorsement served as a powerful call to action, rallying the nation behind this initiative aimed at fostering economic self-sufficiency.

A Collaborative Effort: Government, Business Community, and Civil Society Unite

The inauguration ceremony witnessed the convergence of key stakeholders from various sectors, including representatives from the Central Bank of Liberia, senior government officials, members of the National Legislature, and the business community. Their presence and expressions of support highlighted the collective recognition of the institution’s potential to transform Liberia’s economic landscape. This collaborative spirit underscores the importance of public-private partnerships in driving sustainable development and fostering a vibrant business environment. The event marked not just the opening of a financial institution, but the forging of a united front dedicated to empowering Liberian businesses and promoting economic prosperity.

Leadership and Vision: Chantell Kailondo at the Helm

At the helm of the Modern Savings & Loans Microfinance Deposit-Taking Institution is Madam Chantell Kailondo, serving as the Chief Executive Officer. Her leadership is crucial in realizing the institution’s vision of providing accessible and affordable financial services to Liberian businesses and individuals. As the institution embarks on its mission, Madam Kailondo’s guidance and strategic direction will be instrumental in navigating the challenges and opportunities that lie ahead. Her leadership represents a commitment to fostering a culture of financial inclusivity and empowering Liberians to take control of their economic destinies.