Nigeria Embraces Stablecoins: A New Era in Digital Finance

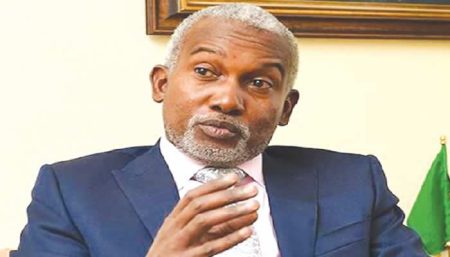

The Securities and Exchange Commission (SEC) of Nigeria has officially opened the country’s doors to stablecoin operations, signaling a significant step towards embracing the potential of digital assets within the nation’s financial landscape. This landmark decision, announced by SEC Director-General Emomotimi Agama at the Nigeria Stablecoin Summit, marks a pivotal moment in Nigeria’s journey towards integrating digital finance into its economic fabric. Agama emphasized that this openness is conditional, predicated on strict adherence to regulatory frameworks designed to safeguard the integrity of Nigerian markets and empower its citizens. This approach seeks to strike a delicate balance between fostering innovation and ensuring responsible adoption of digital assets, aligning with global trends while tailoring solutions specifically to the unique needs and realities of the African continent.

Agama highlighted the dynamic and decentralized nature of Nigeria’s burgeoning digital economy, recognizing the increasing adoption of stablecoins by freelancers, traders, and businesses as a hedge against the volatility of the Nigerian naira. The fluctuating value of the national currency has fueled a surge in demand for dollar-backed digital assets, prompting the SEC to proactively address this evolving financial landscape. The ISA 2025, Nigeria’s updated legal framework, incorporates forward-looking provisions specifically designed for digital asset regulation, thereby establishing a robust legal foundation for the oversight of stablecoins and other digital assets. This framework provides a structured approach to navigating the complexities of the digital asset space while encouraging responsible growth and mitigating potential risks.

Addressing concerns regarding the potential stifling of innovation through regulation, Agama underscored the SEC’s commitment to facilitating responsible growth within the digital asset sector. He pointed to the success of the regulatory sandbox, which continues to attract interest from both domestic and international startups, including firms focused on stablecoin applications. This approach allows the SEC to assess innovative financial products and services in a controlled environment, ensuring compliance with core risk management principles while simultaneously fostering a nurturing environment for innovation. This approach demonstrates a commitment to both fostering innovation and maintaining regulatory oversight.

The SEC’s vision for the future of stablecoins in Nigeria is ambitious and transformative. Agama articulated a vision of a Nigerian stablecoin facilitating cross-border trade across the African continent, envisioning Lagos as a prominent stablecoin hub within the Global South, attracting global capital and driving economic growth. This vision underscores the potential of stablecoins to reshape financial transactions and facilitate economic development within Africa. The integration of stablecoins into the Nigerian economy is not merely a financial endeavor; it represents a strategic initiative towards nation-building, leveraging the potential of digital finance to empower individuals, businesses, and the nation as a whole.

The SEC’s approach to stablecoin regulation represents a proactive and balanced approach, acknowledging the need for flexible frameworks that adapt to the evolving dynamics of the digital asset landscape while simultaneously upholding core principles of investor protection and market integrity. This strategic approach positions Nigeria as a forward-thinking nation within the global digital finance arena, ready to harness the transformative potential of stablecoins to drive economic growth and empower its citizens. The regulatory sandbox provides a practical mechanism for assessing innovation while mitigating risks, ensuring that the adoption of stablecoins aligns with the nation’s broader economic goals and adheres to principles of responsible financial innovation.

The embrace of stablecoins by the Nigerian SEC signifies a profound shift in the nation’s financial landscape, reflecting a strategic recognition of the transformative potential of digital assets. This move positions Nigeria at the forefront of digital finance in Africa, laying the groundwork for a future where stablecoins play a pivotal role in facilitating economic growth, empowering businesses, and fostering financial inclusion. The balanced regulatory approach adopted by the SEC, coupled with its ambitious vision for the future, demonstrates a commitment to harnessing the power of innovation while ensuring the stability and integrity of the financial system. This approach not only addresses the current needs of the Nigerian economy but also lays a solid foundation for future growth and development within the digital asset space.