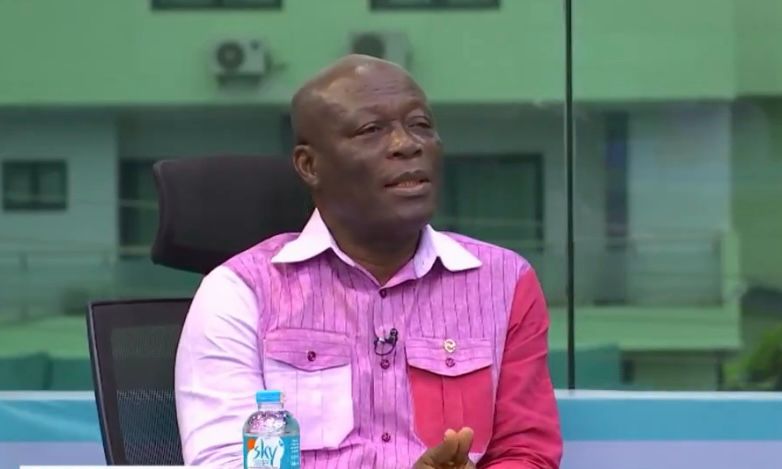

Edwin Nii Lante Vanderpuye, former Member of Parliament for Odododiodio and Coordinator of the District Road Improvement Programme (DRIP), has strongly criticized the now-defunct Electronic Transaction Levy (E-Levy), arguing that it was a poorly designed tax that disproportionately burdened the poor and exacerbated the poverty cycle in Ghana. He contends that the tax, which levied a 1% charge on electronic transactions, placed an undue financial strain on low-income individuals who rely heavily on such transactions for their daily needs. This, he argues, contradicted the fundamental principle of taxation, which should aim to distribute the burden fairly across different income levels, rather than exacerbating existing inequalities. He recalls even the former Vice President acknowledging that electronic transaction taxes predominantly impact the poor, questioning the logic of further burdening an already struggling demographic. Vanderpuye maintains that the E-Levy, far from being a solution to Ghana’s fiscal challenges, only served to deepen the economic hardship faced by its most vulnerable citizens.

Vanderpuye also defended President John Dramani Mahama’s decision to abolish the E-Levy, emphasizing that the tax failed to achieve its intended purpose of generating substantial revenue. Despite initial skepticism and concerns about the potential impact on the International Monetary Fund (IMF) program, Mahama, along with his finance minister, successfully identified alternative revenue streams to offset the loss from the E-Levy, demonstrating a commitment to fiscal responsibility without resorting to regressive taxation. This decisive action, according to Vanderpuye, underscores Mahama’s pragmatism and dedication to alleviating the financial burden on ordinary Ghanaians, while simultaneously maintaining fiscal stability.

The former MP highlighted the E-Levy’s underperformance in terms of revenue generation. He pointed out that the levy consistently fell short of its projected targets, failing to generate even 50% of the expected revenue in its first year. Although there was a slight improvement in the second year, it still remained significantly below expectations. This, according to Vanderpuye, further reinforces the argument that the E-Levy was not an effective revenue-generating mechanism and its abolition was justified. He questions the rationale behind maintaining a tax that demonstrably failed to deliver on its primary objective, particularly when alternative and less burdensome revenue sources were available.

Vanderpuye’s critique of the E-Levy centers on its regressive nature, which disproportionately impacted low-income earners. He emphasizes that taxing essential electronic transactions, frequently used by the poor for everyday necessities, only served to deepen their financial struggles. This, he argued, ran counter to the principles of equitable taxation, which should aim to distribute the tax burden fairly across different income groups. By placing a heavier burden on those least able to afford it, the E-Levy, according to Vanderpuye, perpetuated and exacerbated the cycle of poverty in Ghana.

Furthermore, Vanderpuye’s defense of the E-Levy’s abolition highlights the importance of finding alternative revenue streams that do not unfairly target vulnerable populations. He commends the Mahama administration for demonstrating that fiscal responsibility does not necessitate regressive taxation. By identifying alternative sources of revenue, the government was able to eliminate a burdensome tax without jeopardizing fiscal stability or the IMF program. This, Vanderpuye suggests, is a testament to responsible governance and a commitment to prioritizing the welfare of the citizenry.

In conclusion, Vanderpuye’s argument against the E-Levy rests on its inherent flaws: it was a regressive tax that disproportionately affected the poor, failed to achieve its revenue targets, and was ultimately replaced by alternative revenue sources that did not impose an additional burden on vulnerable populations. His perspective underscores the importance of designing tax policies that are both effective and equitable, ensuring that the burden of taxation is distributed fairly and does not exacerbate existing inequalities. He champions the abolition of the E-Levy as a victory for economic justice and a step towards building a more inclusive and equitable financial system in Ghana.