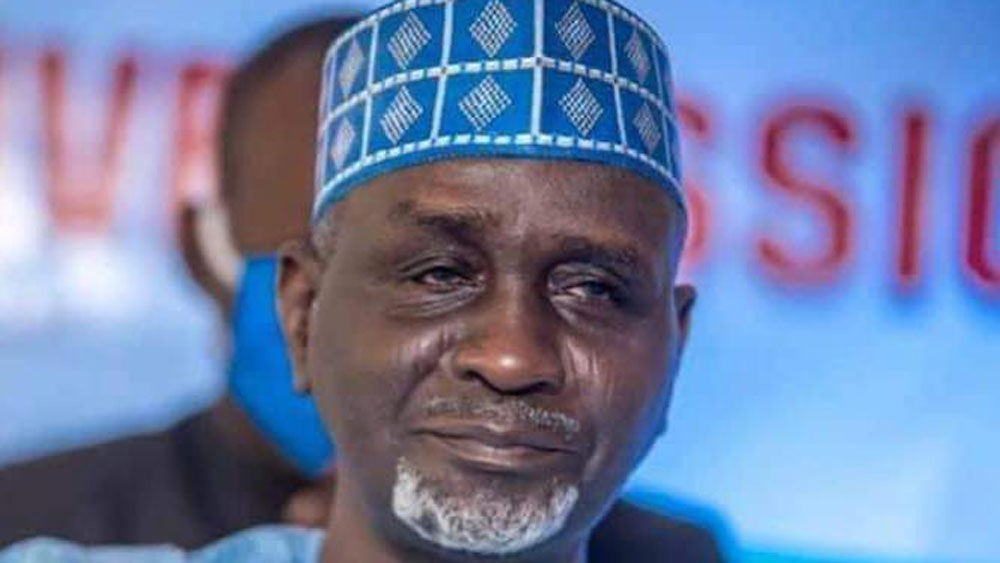

The League of Northern Democrats (LND), a prominent political group in Nigeria, has expressed both support and reservations regarding President Bola Tinubu’s proposed tax reform bills. While acknowledging the urgent need for tax reform in Nigeria, the LND emphasizes the importance of addressing critical concerns surrounding the bills to ensure they don’t exacerbate existing economic hardships faced by citizens. The LND’s stance, articulated by its chairman, Senator Ibrahim Shekarau, and further elaborated by Senator Bala Ibn Na’Allah, chairman of the LND’s technical committee tasked with reviewing the bills, calls for a balanced approach that fosters economic growth while safeguarding the interests of the Nigerian populace.

The LND’s primary concern revolves around the potential negative impact of the proposed reforms on the already vulnerable segments of the population. While recognizing the need to broaden the tax base and improve tax collection efficiency, the LND stresses the importance of considering the socio-cultural implications of the proposed changes. Specifically, the League objects to clauses within the Nigeria Tax Bill that could infringe upon religious and cultural practices related to inheritance, advocating for their removal. This careful consideration of the cultural context underscores the LND’s commitment to ensuring the reforms are not perceived as insensitive or disruptive to established societal norms.

Furthermore, the LND raises concerns about the proposed sunsetting of key development funds, namely the Tertiary Education Trust Fund (TETFund) and the National Information Technology Development Agency (NITDA) fund. The League argues that these funds are crucial for the development of critical sectors, highlighting TETFund’s role in supporting tertiary education infrastructure and research, and NITDA’s contribution to enhancing digital literacy. Transferring these funds to the National Electricity Levy Fund, as proposed in the bills, could jeopardize progress in these vital areas. The LND believes that a robust educational system and a digitally literate population are essential for long-term economic growth and should be prioritized.

The LND also draws a comparison between Nigeria’s proposed tax system and that of South Africa, noting a significant difference in the size of their respective informal sectors. South Africa’s smaller informal sector, coupled with a robust identification system and digital infrastructure, allows for more effective tax capture. Nigeria, with a significantly larger informal sector, faces greater challenges in capturing tax revenue from this segment of the economy. Therefore, the LND emphasizes the need for tailored solutions that address the unique challenges posed by Nigeria’s large informal sector, suggesting that simply replicating the South African model may not be effective.

The LND further expresses reservations regarding the corporate governance structure of the proposed Nigeria Revenue Service, particularly the dual role of the Executive Chairman as both CEO and Chairman of the Governing Board. The League advocates for the separation of these roles to ensure greater transparency and accountability within the organization. This recommendation reflects the LND’s commitment to good governance and its belief that a clear separation of powers is essential for preventing potential conflicts of interest and promoting effective oversight. This concern extends to the State Inland Revenue Service, where similar corporate governance issues are identified.

Finally, the LND critically examines the current Value Added Tax (VAT) distribution formula, particularly concerning the derivation principle, which allocates a portion of VAT revenue based on the origin of the tax. The League’s analysis reveals significant disparities in VAT allocation, with Lagos and Rivers States receiving a disproportionately large share compared to other states, especially those in the Southeast. The LND attributes this disparity to the current interpretation of the derivation principle, which favors states hosting the headquarters of companies remitting VAT centrally. They propose amendments to the Tax Administration Bill to clarify the definition of “derivation” and ensure a more equitable distribution of VAT revenue among states, promoting balanced regional development. The LND’s detailed analysis of VAT allocation and its call for a fairer system underscores its commitment to equitable resource distribution and national unity.