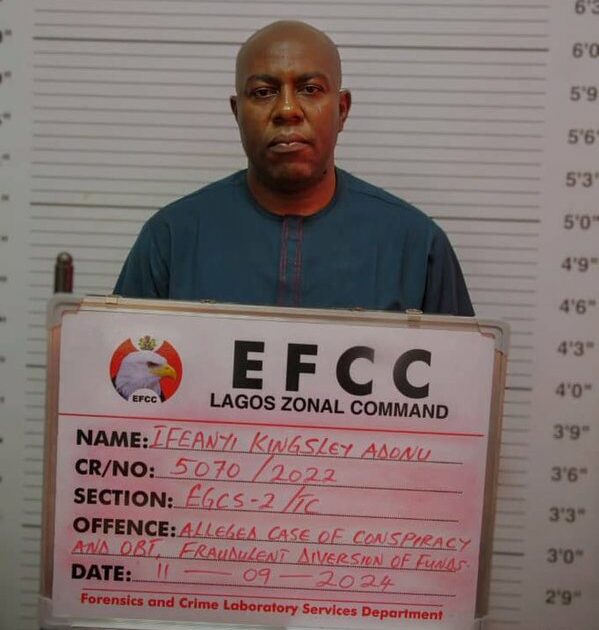

This case revolves around Adonu Kingsley Ifeanyi, who stands accused of orchestrating a sophisticated money laundering scheme involving over N10 billion. The Economic and Financial Crimes Commission (EFCC) alleges that Ifeanyi, operating under the guise of S. Mobile Netzone Limited, fraudulently presented himself as a partner of MTN Nigeria, a prominent telecommunications company. The alleged illicit activities, carried out between June 2021 and July 2022, involved channeling vast sums of money believed to be proceeds of unlawful activities through various bank accounts. The EFCC contends that Ifeanyi knowingly took possession of these funds, effectively laundering them through accounts linked to S. Mobile Netzone Limited and another entity, Setbiz Datalink Concept Limited.

The EFCC has meticulously outlined a series of transactions that paint a picture of a complex financial operation designed to obscure the origin and destination of the funds. The first instance cited involves over N1 billion allegedly laundered through S. Mobile Netzone Limited’s account between June and July 2021. A further N656.4 million is alleged to have been moved through the same account during a similar period. The most substantial sum implicated in this scheme, a staggering N6.79 billion, was allegedly transferred between January 2021 and April 2022, again through the S. Mobile Netzone Limited account.

The prosecution’s case continues with further allegations of illicit financial maneuvers. An additional N959 million flowed through the S. Mobile Netzone Limited account between March and July 2022. Furthermore, the EFCC claims that Ifeanyi used a separate account, belonging to Setbiz Datalink Concept Limited, to launder N530 million between March 15 and 31, 2022. The accumulated sum of these transactions forms the basis of the N10 billion money laundering charge against Ifeanyi. The EFCC argues that these actions constitute a clear violation of the Money Laundering (Prohibition) Act, 2011 (as amended).

The charges against Ifeanyi are grounded in the alleged violation of Section 15(2)(d) of the Money Laundering (Prohibition) Act, 2011 (as amended), which addresses the unlawful possession of funds derived from criminal activities. The EFCC contends that Ifeanyi’s actions fall under the purview of this section, as he knowingly took control of substantial amounts of money that can be traced back to illegal sources. The prosecution further asserts that the act of channeling these funds through multiple accounts, including those of S. Mobile Netzone Limited and Setbiz Datalink Concept Limited, constitutes a deliberate attempt to conceal their illicit origins and avoid detection by authorities.

The court proceedings commenced with Ifeanyi pleading not guilty to the five-count charge of money laundering. The prosecution, represented by Suleiman I. Suleiman, promptly requested a trial date and sought the defendant’s remand in custody at the correctional center pending trial. The defense counsel, Chibuike Opara, agreed on the need for a trial date but requested that Ifeanyi be remanded in EFCC custody instead, pending the filing and determination of a bail application. This request was opposed by the prosecution, who argued that the correctional center was the appropriate place of detention for an arraigned defendant.

Presiding Justice Chukwujekwu Aneke ruled in favor of the prosecution’s request, ordering Ifeanyi to be remanded at the Ikoyi Correctional Centre. The court then adjourned the case to July 4, 2025, to hear the bail application. This date sets the stage for the next chapter in this legal battle, where the defense will present its arguments for Ifeanyi’s release on bail while awaiting trial. The court’s decision on the bail application will significantly impact the course of the proceedings and determine whether Ifeanyi will remain in custody or be granted temporary freedom until the trial concludes. The significant time gap between the arraignment and the bail hearing, as well as the eventual trial, underscores the complexities and potential delays inherent in legal proceedings of this nature.

The implications of this case extend beyond the individual defendant. The alleged involvement of a purported partnership with MTN Nigeria raises questions about potential reputational damage to the telecommunications giant. While MTN Nigeria itself is not implicated in any wrongdoing, the association with the alleged fraudulent scheme could negatively impact public perception of the company. Furthermore, this case highlights the vulnerability of individuals to Ponzi schemes and other forms of financial fraud. The alleged scale of the operation underscores the importance of public awareness and due diligence when engaging in investment opportunities. The outcome of this case will undoubtedly be closely watched by both the public and the corporate world.