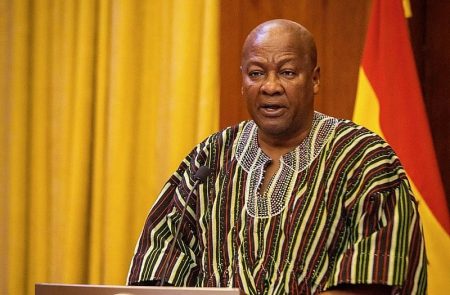

The Ghana Revenue Authority (GRA) has initiated a comprehensive process to fully implement the repeal of the 1% Electronic Transfer Levy (E-Levy), effective April 2, 2025. This action follows President John Mahama’s assent to the repeal bill, fulfilling a key campaign promise. The GRA has issued a clear directive to all financial institutions and electronic money operators, mandating them to immediately cease all E-Levy deductions and promptly refund any amounts deducted after the repeal date. This directive underscores the government’s commitment to swiftly and efficiently remove the levy, addressing widespread public discontent and fulfilling its promise to alleviate the financial burden on citizens. The GRA has emphasized the need for strict adherence to this directive, warning of legal sanctions for non-compliance. This decisive action marks a significant shift in fiscal policy and aims to restore public trust in the financial system.

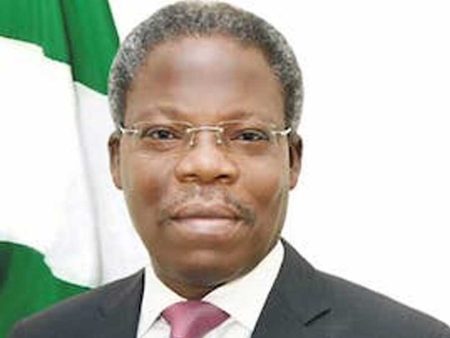

The GRA, in its commitment to ensuring seamless implementation of the repeal, has taken proactive steps to prevent further deductions. Edward Apenteng Gyamerah, Commissioner of the Domestic Tax Revenue Division, confirmed that the GRA’s Electronic Transfer Levy Management and Assurance System (ELMAS) has been reconfigured to automatically prevent any further E-Levy charges. This technical adjustment ensures that all electronic transfers are processed without the levy, effectively halting any further deductions at the system level. The GRA has also reassured the public that any inadvertent deductions made after the repeal will be promptly refunded. Commissioner General Anthony Kwasi Sarpong reiterated this commitment, guaranteeing refunds for any deductions made after 11 PM on April 2, 2025. This proactive approach demonstrates the GRA’s dedication to minimizing disruption and ensuring a smooth transition following the levy’s abolishment.

Recognizing the complexities of implementing such a change across various platforms, the GRA has initiated direct engagement with telecommunication companies (telcos) to facilitate the removal of the E-Levy from their systems. While acknowledging the inherent time lag associated with technological adjustments, the GRA has emphasized its commitment to working closely with telcos to expedite the process. This collaboration is crucial to achieving a comprehensive and timely repeal of the E-Levy across all electronic transfer channels. The GRA’s efforts underscore the importance of collaboration between government agencies and private sector stakeholders in achieving effective policy implementation.

Financial institutions and mobile money platforms have been instructed to implement a three-pronged approach to ensure complete compliance with the E-Levy repeal. First, they must immediately cease charging the 1% levy on all transactions, regardless of the platform or channel used. This directive ensures that no further E-Levy deductions occur, effectively ending the levy’s application. Second, these institutions must establish expedited processes for refunding any E-Levy amounts erroneously deducted from customers after April 2, 2025. This requirement underlines the GRA’s commitment to promptly rectifying any unintended deductions and restoring funds to affected customers. Third, they are mandated to maintain meticulous records of all refunds issued. This documentation serves as evidence of compliance and provides a transparent audit trail of the refund process.

In addition to the refund process, financial institutions are obligated to remit all outstanding E-Levy charges collected prior to the April 2nd repeal date. This requirement ensures that all revenue collected under the E-Levy prior to its abolishment is properly accounted for and remitted to the GRA. This comprehensive approach to managing the transition ensures financial accountability and prevents any loss of revenue during the transition period. The GRA’s commitment to transparency and accountability is further demonstrated by its requirement for ongoing reporting of all electronic transfer transactions by telcos, as stipulated by the Revenue Administration Act. This continuous monitoring allows the GRA to oversee the transition and ensure that the repeal is effectively implemented across all platforms.

The repeal of the E-Levy marks a significant policy shift in Ghana, driven by widespread public opposition to the tax. Introduced in May 2022, the E-Levy faced considerable resistance from citizens who viewed it as an additional financial burden. The government’s decision to abolish the levy signifies a responsiveness to public sentiment and a commitment to addressing concerns about the tax’s impact on citizens. This move is seen as a positive step towards building public trust and fostering a more equitable tax system. The GRA’s diligent efforts to implement the repeal swiftly and efficiently further underscore the government’s commitment to fulfilling its promise and ensuring a smooth transition for all stakeholders. By taking proactive measures to prevent further deductions, facilitate refunds, and maintain transparency throughout the process, the GRA aims to restore public confidence in the financial system and solidify its commitment to responsive governance.