Paragraph 1: A Positive Outlook on Nigeria’s Forex Policies

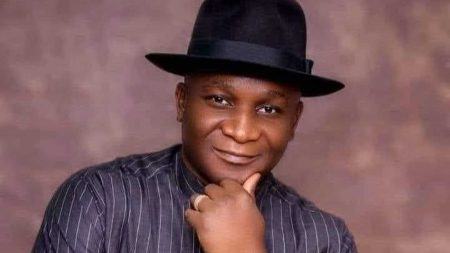

Bismarck Rewane, Managing Director of Financial Derivatives Company, has expressed strong support for the Central Bank of Nigeria’s (CBN) foreign exchange policies, emphasizing their effectiveness in driving the naira towards its true market value. His optimistic assessment comes amid recent improvements in the naira’s performance across both official and parallel markets. The strengthening of the naira signals a positive shift in the Nigerian economy, suggesting that the CBN’s interventions are having a tangible impact. Rewane’s analysis highlights the importance of aligning the naira with its fair value, which is crucial for economic stability and sustainable growth.

Paragraph 2: Determining the Fair Value of the Naira

Rewane explained that based on Purchasing Power Parity (PPP) analysis, the fair value of the naira is estimated at 1,102.15 against the US dollar. This indicates that the naira is currently undervalued by approximately 26.35%. He argues that intervening to support an undervalued currency, unlike defending an overvalued one, is a corrective measure that helps realign the currency with market fundamentals. The CBN’s efforts, therefore, are viewed as a necessary step towards restoring the naira’s rightful position in the foreign exchange market. This approach aims to create a more balanced and sustainable exchange rate regime.

Paragraph 3: Evidence of Policy Success

Several indicators point to the efficacy of the CBN’s policies. Firstly, the gap between the official and parallel market exchange rates has significantly narrowed to less than one percent, a substantial improvement compared to previous disparities reaching 10-20%. This convergence signifies improved market efficiency and reduced speculative activities. Secondly, the influence of informal exchange rate platforms like Aboki FX has diminished, reflecting a shift towards more transparent and regulated market dynamics. Finally, Nigeria’s balance of trade has reached a commendable $18.6 billion, a substantial increase attributed to reduced imports and increased exports. This positive trade balance is a direct consequence of the exchange rate adjustments and policies promoting export-oriented growth.

Paragraph 4: The Impact of Import Substitution and Export Promotion

The observed improvement in Nigeria’s trade balance underscores the double-pronged effect of the CBN’s policies: import substitution and export promotion. The devaluation of the naira has made imports more expensive, incentivizing domestic production and reducing reliance on foreign goods. Simultaneously, the weaker naira makes Nigerian exports more competitive in the global market, boosting export revenues. This shift towards local production not only strengthens the domestic economy but also contributes to a more sustainable long-term economic model. The market’s recognition of the profitability of import substitution further reinforces the effectiveness of these policies.

Paragraph 5: Market Dynamics and Economic Implications

The success of these policies hinges on the responsiveness of both the market and individual economic agents. Importers are adapting to higher costs by exploring local alternatives, while exporters are capitalizing on the favorable exchange rate to expand their international reach. This positive feedback loop reinforces the effectiveness of the CBN’s interventions and contributes to a more balanced and resilient economy. The combination of market-driven adjustments and policy support creates a positive synergy that promotes economic growth and stability.

Paragraph 6: Rewane’s Conclusion and Future Outlook

Rewane concludes that the CBN’s foreign exchange policies are proving effective in stabilizing the naira and promoting a healthier trade balance. The narrowing gap between official and parallel market rates, the reduced reliance on unofficial exchange rate platforms, and the surge in the balance of trade all serve as evidence of the policies’ positive impact. The success of these policies will likely depend on sustained implementation and further adjustments to respond to evolving market dynamics. Looking ahead, continued monitoring and refinement of these policies will be crucial for maintaining Nigeria’s economic trajectory toward sustainable growth and stability.