Paragraph 1: Senate Finance Committee Sets Public Hearing on Tax Reform Bills

The Senate Committee on Finance has scheduled a two-day public hearing to deliberate on a series of crucial tax reform bills. This hearing, slated for February 24th and 25th, aims to solicit input from the public and key organizations regarding proposed changes to Nigeria’s tax system. The bills under consideration include the Joint Revenue Board Establishment Fund Bill, the Nigerian Revenue Services Bill, the Nigerian Tax Administration Bill, and the Nigerian Tax Bill. These bills, submitted by President Bola Tinubu in 2024, have already undergone second reading in both chambers of the National Assembly, paving the way for this crucial public input phase.

Paragraph 2: Objectives of the Tax Reform Bills

The primary objective of these legislative proposals is to overhaul and modernize Nigeria’s tax administration, collection processes, and overall tax operations. The overarching goal is to enhance government revenue generation, providing the necessary financial resources to bolster critical sectors of the Nigerian economy. These sectors include infrastructure development, education, agriculture, and other areas essential for national growth and prosperity. The reforms are aligned with President Tinubu’s vision for economic advancement and reflect the government’s commitment to achieving a robust and sustainable fiscal landscape.

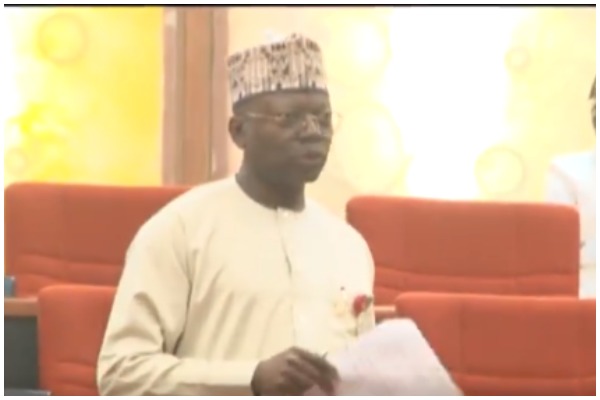

Paragraph 3: Senate Committee’s Approach and Engagement with Stakeholders

The Senate Committee on Finance has emphasized its commitment to a thorough and transparent review of the tax reform bills. Prior to the public hearing, committee members diligently scrutinized the proposed legislation and engaged with various stakeholders to gather diverse perspectives and insights. Senator Sani Musa, Chairman of the Committee, stressed the importance of incorporating input from different segments of Nigerian society, representing diverse tribal, religious, and geographical backgrounds, to ensure the final legislation serves the best interests of the nation. The committee has also sought expert opinions from heads of key agencies to gain a comprehensive understanding of the current economic landscape.

Paragraph 4: Invitations to Key Government Officials and Agencies

To facilitate a well-informed discussion, the Senate Committee has extended invitations to several high-ranking government officials and heads of relevant agencies. The invitees include the Minister of Finance and Coordinating Minister of the Economy, the Minister of Trade and Investment, the Attorney General of the Federation, the Minister of Petroleum, the Chairman of the Federal Inland Revenue Services (FIRS), and the Statistician General of Nigeria, who heads the National Bureau of Statistics (NBS). These individuals will provide crucial data and insights into the current state of the economy, allowing the committee to make informed decisions in shaping the tax reform legislation.

Paragraph 5: Focus on Data-Driven Decision-Making and Communication with Constituents

The Senate Committee underscores its commitment to evidence-based decision-making. Beyond relying on news reports and secondary sources, the committee seeks firsthand accounts from key officials to gain a deeper understanding of the practical realities of Nigeria’s economic landscape. Recognizing Nigeria’s leading economic position in Africa, the committee aims to enact legislation that propels the nation forward. Committee members have also actively engaged with their constituents to gather grassroots perspectives on the proposed tax reforms, ensuring that the final legislation reflects the needs and aspirations of the Nigerian people.

Paragraph 6: Engagement with MOFI and its Role in Economic Transformation

The Senate Committee also interacted with executives from the Ministry of Finance Incorporated (MOFI), recognizing the agency’s pivotal role in managing federal government assets and portfolios. The committee praised MOFI’s initiatives to positively impact the overall economy and acknowledged its crucial role as custodian of government assets. While commending MOFI’s progress, the committee also identified areas for improvement and received assurances from the agency regarding their commitment to addressing these concerns. The committee intends to maintain ongoing engagement with MOFI to monitor progress and ensure alignment with national economic goals. This closed-door session with MOFI and the subsequent internal deliberations within the finance committee remain confidential, highlighting the sensitivity and importance of the matters discussed.