SIC Insurance PLC, a leading insurance provider, demonstrated its commitment to customer satisfaction and prompt claims settlement by disbursing a significant sum of $1,020,77.98 to the Volta River Authority (VRA). This substantial payment covered damages incurred from an unexpected explosion of a feed water pipeline connected to the boiler of VRA’s Heat Recovery Steam Generator situated in Aboadze, Takoradi, within the Western Region of Ghana. This incident fell under the purview of VRA’s comprehensive Asset All Risk Policy, highlighting the importance of robust insurance coverage in mitigating unforeseen operational disruptions and financial losses. The handover of the claim cheque underscored SIC Insurance PLC’s dedication to upholding its contractual obligations and solidifying its reputation as a dependable insurance partner.

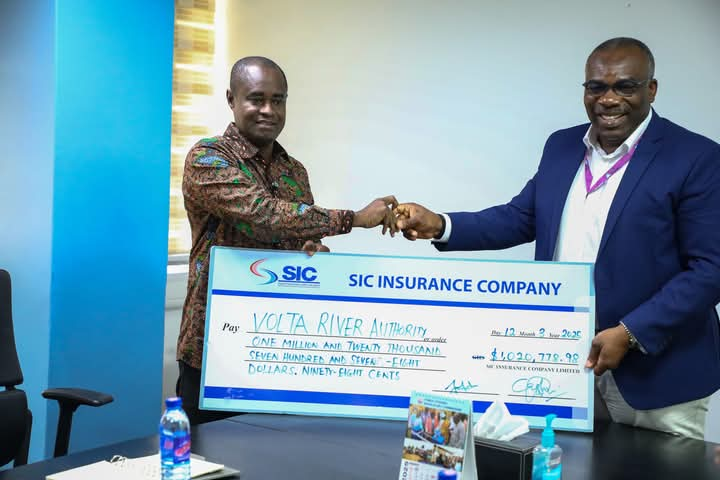

The transaction, which took place at VRA’s headquarters in Accra, involved key representatives from both organizations. Mr. James Agyenim-Boateng, the Acting Managing Director of SIC Insurance PLC, presented the cheque to Ing. Edward Ekow Obeng-Kenso, the CEO of VRA. Mr. Agyenim-Boateng emphasized SIC Insurance PLC’s unwavering commitment to its clients, highlighting their dedication to integrity, excellence, and professionalism. This substantial payout, he explained, served as tangible proof of their pledge to prioritize customer satisfaction and ensure timely claims processing. He reassured the business community of SIC’s robust financial standing and its capacity to handle significant claims promptly, solidifying their position as a reliable insurance partner.

Beyond this recent incident, the relationship between SIC Insurance PLC and VRA has a history of successful claims settlements. Mr. Agyenim-Boateng recalled a previous instance in 2021 where SIC Insurance PLC honored a claim of $4.3 million to VRA, covering damages to one of their insured generators. This consistent track record of fulfilling obligations underscores SIC Insurance PLC’s financial stability and their dedication to providing reliable coverage to their clients. These substantial payouts serve as concrete examples of SIC Insurance PLC’s commitment to standing by their clients during challenging times and honoring their commitments.

The proactive approach of SIC Insurance PLC in expediting the claims process was also a key highlight of the interaction. Mr. Agyenim-Boateng contrasted this with the common industry practice where clients often need to pursue insurance companies for their due payments. SIC Insurance PLC, he explained, takes pride in proactively reaching out to clients to ensure timely disbursement of claims. This customer-centric approach further reinforces their commitment to building strong, long-lasting relationships based on trust and mutual respect. He urged businesses seeking dependable insurance coverage to partner with SIC Insurance PLC, emphasizing their commitment to providing reliable support and timely assistance in times of need.

Ing. Edward Ekow Obeng-Kenso, the CEO of VRA, expressed his gratitude to SIC Insurance PLC for their prompt payment and commended their efficient handling of the claim. He highlighted the significance of collaboration between state-owned entities like VRA and SIC Insurance PLC, advocating for closer cooperation to enhance efficiency and effectiveness. This partnership, he emphasized, serves as a testament to the capability of state agencies to conduct business with the same professionalism and efficiency as their private sector counterparts. He envisioned a stronger partnership between the two organizations to demonstrate the capacity of state-owned enterprises in driving economic growth and providing reliable services.

The successful claim settlement serves as a compelling case study highlighting the importance of robust insurance coverage, particularly in industries with inherent operational risks such as power generation. VRA’s experience underscores the value of partnering with a dependable insurance provider like SIC Insurance PLC, capable of providing comprehensive coverage and ensuring prompt financial support in times of unforeseen events. This incident reinforces the value proposition of insurance as a critical risk management tool for businesses, protecting them from potential financial setbacks and ensuring business continuity. Furthermore, it emphasizes the importance of choosing an insurance partner with a proven track record of reliability and a strong commitment to customer satisfaction.