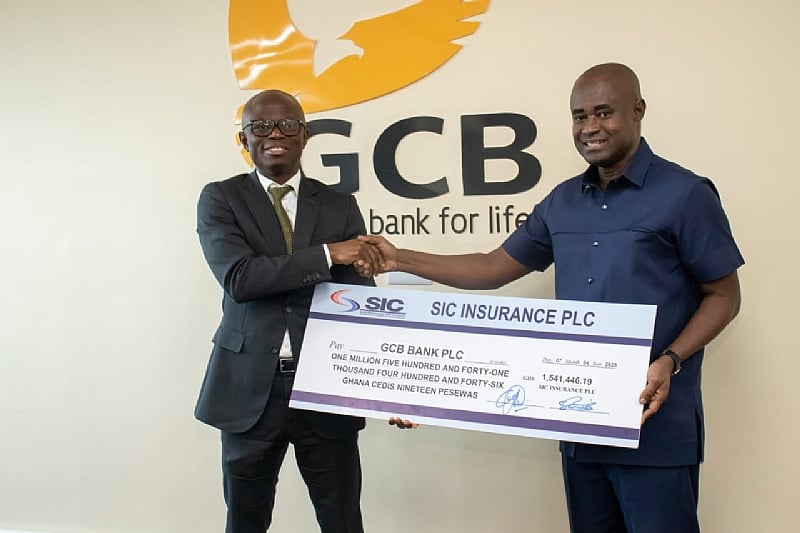

SIC Insurance PLC, a prominent insurance provider in Ghana, recently demonstrated its commitment to prompt claim settlements by disbursing a substantial sum of GHS 1,541,446.19 to GCB Bank PLC. This payment, stemming from GCB Bank’s Bankers Blanket Policy, underscores SIC Insurance’s dedication to fulfilling its obligations and solidifying its reputation as a reliable insurance partner. The transaction was marked by a formal cheque presentation at GCB Bank’s headquarters in Accra, attended by key representatives from both institutions. This event served not only as a symbolic gesture of financial responsibility but also as a platform for SIC Insurance to reaffirm its financial stability and promptness in processing claims.

Mr. James Agyenim-Boateng, the Acting Managing Director of SIC Insurance, took the opportunity to express gratitude for GCB Bank’s longstanding business relationship. He emphasized SIC Insurance’s robust financial standing and its commitment to timely claim settlements, subtly encouraging the business community to prioritize SIC Insurance for their insurance needs. He highlighted recent significant claim payouts, including a million-dollar settlement in Accra and another substantial payment of $780,000 in Tema, showcasing the company’s ability to handle large claims efficiently. These examples served to reinforce the message of SIC Insurance’s financial stability and its dedication to honoring its commitments.

The presentation of the cheque underscored SIC Insurance’s commitment to GCB Bank. Mr. Agyenim-Boateng’s words, “At SIC Insurance PLC, we value our relationship with GCB Bank, we take our promises seriously as our promises are sacred,” echoed the company’s dedication to maintaining strong client relationships built on trust and reliability. His assurance, “Continue to stand by us and when bad time comes, we will chase you with your cheque to come and present to you,” conveyed the company’s proactive stance in handling claims and its commitment to providing timely financial support to its clients during unforeseen circumstances.

Mr. Socrates Afram, the Deputy Managing Director (Finance) of GCB Bank, reciprocated the sentiment by acknowledging the mutually beneficial relationship between the two institutions. This reciprocal appreciation highlights the collaborative nature of their partnership and underscores the shared values of trust and reliability that underpin their business interaction. The exchange between the two institutions exemplified a strong business relationship built on mutual respect and a shared understanding of the importance of financial security.

The prompt settlement of GCB Bank’s claim serves as a testament to SIC Insurance’s dedication to upholding its promises and maintaining a strong financial position. This demonstrates not just a business transaction but a commitment to fostering long-term partnerships based on trust and mutual benefit. By prioritizing efficient claim processing and open communication, SIC Insurance solidifies its reputation as a reliable insurance provider dedicated to protecting its clients’ interests.

This event showcasing SIC Insurance’s prompt claim settlement to GCB Bank holds broader significance for the Ghanaian insurance landscape. It reinforces the importance of financial stability and reliability within the insurance sector, promoting trust and confidence among businesses seeking insurance coverage. SIC Insurance’s proactive approach to claim settlements, coupled with its emphasis on strong client relationships, sets a positive example within the industry. This transaction ultimately contributes to a more secure and reliable insurance environment, benefiting both businesses and the overall Ghanaian economy.