The Nigerian telecommunications landscape is poised for a significant shift as mobile network operators (MNOs), including industry giants MTN and Airtel, prepare to disconnect banks from the Unstructured Supplementary Service Data (USSD) service due to mounting unpaid debts. This critical service, widely used by millions of Nigerians for mobile banking, facilitates transactions without requiring internet access, making it a crucial tool for financial inclusion in a nation where internet penetration remains patchy. The looming disconnection follows a directive from the Nigerian Communications Commission (NCC), the telecom regulator, issued on January 15, 2025, giving nine banks a deadline of January 27, 2025, to settle their outstanding dues.

The brewing conflict centers around the accumulation of substantial debts owed to MNOs by these banks for the provision of USSD services. While some banks have reportedly responded positively to the regulatory pressure from both the NCC and the Central Bank of Nigeria (CBN) by making partial or full payments, several others remain defiant, prompting the MNOs to take the drastic step of threatening disconnection. This action underscores the escalating tension between the telecommunications and banking sectors and highlights the crucial role of USSD in Nigeria’s financial ecosystem. The potential disruption to millions of customers who rely on USSD for their daily banking needs raises concerns about the wider impact on financial inclusion and economic activity.

The regulatory efforts to mediate this dispute have been ongoing. In December 2024, the CBN and the NCC jointly issued a directive requiring banks to pay at least 85% of their outstanding USSD invoices by December 31, 2024. These invoices reportedly date back to February 2022, indicating a protracted period of non-payment. However, the banks contested the regulatory directive, leading to the NCC publicly naming the nine defaulting institutions. This public pressure tactic aimed to compel the banks to comply and avoid the looming disconnection. The resistance from the banks, however, indicates deeper disagreements regarding the billing structure, cost-sharing mechanisms, or perhaps other underlying contractual disputes.

The importance of USSD in Nigeria’s financial ecosystem cannot be overstated. Data from the CBN reveals that between January and June 2024, a staggering 252.06 million USSD transactions were conducted, amounting to a total value of N2.19 trillion. While this represents a decline compared to the 630.6 million transactions worth N4.84 trillion recorded in the same period the previous year, it nonetheless underscores the significant volume of financial transactions facilitated by this technology. The potential disruption caused by the disconnection could have far-reaching consequences, impacting individuals, businesses, and the overall economy. The drop in transactions from the previous year may also indicate growing awareness of this impending issue and potential preemptive actions by users.

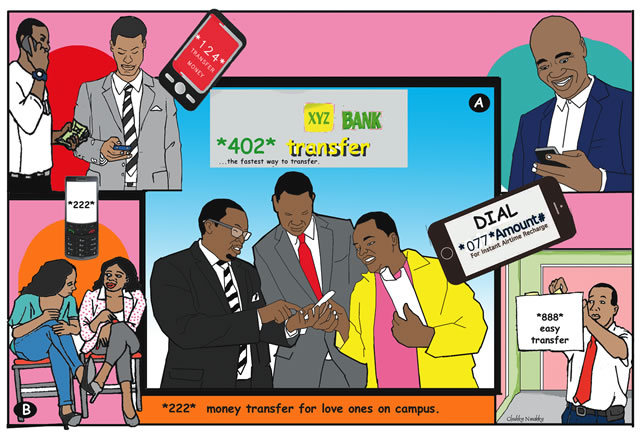

Originally conceived by telecom operators for basic services like airtime purchases and managing mobile subscriptions, USSD has evolved into a powerful tool for financial inclusion in developing economies. Its simplicity and accessibility, requiring only a basic mobile phone without internet connectivity, make it particularly valuable in regions with limited internet access. In Nigeria, where significant portions of the population remain unconnected to the internet, USSD has become a lifeline for accessing essential banking services. This includes balance inquiries, fund transfers, bill payments, and other crucial transactions, effectively bridging the gap between the formal financial system and the underserved population.

The standoff between MNOs and banks over USSD debts raises critical questions about the sustainability of this essential service. While the MNOs argue that they are owed significant sums for providing the infrastructure and connectivity that underpins USSD services, the banks may be contesting the billing structure or the perceived high cost of these services. A sustainable solution requires a transparent and mutually agreeable framework for cost-sharing and revenue distribution. This could involve further regulatory intervention to establish clear pricing guidelines, dispute resolution mechanisms, and perhaps incentives for promoting wider adoption of alternative digital payment solutions.

The impending disconnection of USSD services to banks in Nigeria highlights a critical juncture in the evolution of digital financial services. Finding a balanced approach that ensures the financial viability of MNOs while maintaining the accessibility and affordability of USSD for end-users is paramount. The outcome of this dispute will have significant implications for the future of financial inclusion in Nigeria and could serve as a case study for other developing economies grappling with similar challenges. The need for a collaborative and forward-looking approach involving all stakeholders – MNOs, banks, regulators, and consumers – is crucial to ensuring the long-term sustainability and accessibility of vital digital financial services like USSD. Failure to reach a resolution could stifle innovation and hinder the progress made towards a more inclusive digital financial ecosystem.