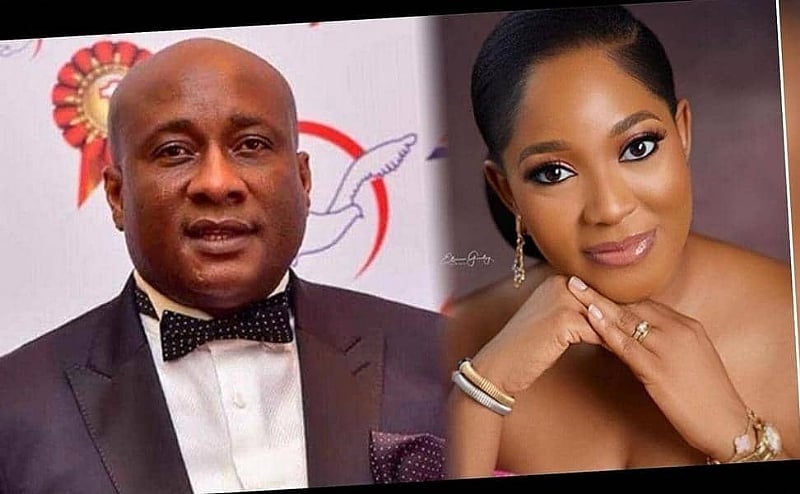

The U.S. District Court for the Northern District of Georgia has taken significant legal action against Ejiroghene Eghagha, the Chief of Finance and Administration for the Nigerian airline Air Peace, by issuing an arrest warrant and labeling her a fugitive. This move underscores the gravity of her situation amidst the ongoing legal troubles facing Allen Onyema, Air Peace’s CEO and founder, who is entangled in serious criminal charges tied to a multimillion-dollar fraud scheme. The case has captured attention due to its implications for international aviation and corporate integrity, highlighting the potential for systemic abuse in financial dealings within the aviation sector.

Allen Onyema’s legal woes trace back to 2019 when the U.S. Attorney’s office formally accused him of bank and wire fraud. The allegations suggest that he engaged in deceptive practices to secure financing for Boeing aircraft that he had already purchased. Central to the controversy is the establishment of Springfield Aviation, which involved hiring an unqualified manager and submitting fraudulent documents to secure letters of credit from U.S. banks. Such actions not only raise questions about regulatory compliance but also spotlight potential vulnerabilities in the financial oversight of airline operations and cross-border transactions.

The unfolding legal drama intensified as U.S. and Canadian financial authorities froze accounts containing millions linked to Onyema. In a bid to mitigate the damage, Onyema and Eghagha concocted a fraudulent contract, backdating it to lend it an air of legitimacy, and subsequently submitted it to the U.S. Attorney’s office. This attempt to obstruct the investigation resulted in new charges against both individuals, including allegations that they sought to undermine the integrity of the U.S. justice system. The legal narrative reveals a troubling pattern of misconduct that raises ethical concerns about corporate governance and the responsibilities of high-ranking officials in aviation enterprises.

A comprehensive examination of the previous charges against Onyema reveals a complex web of alleged financial crimes. He is believed to have moved upwards of $20 million from Nigeria into U.S. bank accounts by utilizing false documentation linked to aircraft purchases. Moreover, he has been accused of laundering over $3 million—funds that were supposedly sourced from bank accounts associated with his non-profit organizations. The serious nature of these accusations culminates in the charge of aggravated identity theft, highlighting the severity of the alleged misconduct and the potential legal ramifications for Onyema and his associates.

The case against Onyema and Eghagha fits within the framework of an Organized Crime Drug Enforcement Task Forces (OCDETF) operation, which aims to identify, disrupt, and dismantle significant criminal organizations. This affiliation emphasizes the broad scale of the accusations and the serious commitment of U.S. authorities to tackle high-level financial crime. The implications of this legal battle stretch beyond the individuals involved, as they signal to regulatory bodies the necessity for heightened vigilance in monitoring corporate behavior in the aviation industry, especially with multimillion-dollar transactions.

In conclusion, the arrest warrant for Ejiroghene Eghagha and the renewed charges against Allen Onyema present a critical moment for the airline industry and financial regulation. The ongoing investigation underscores the complexities of international trade and finance, revealing the potential for exploitation within the systems designed to support legitimate business operations. As the legal proceedings advance, this case serves as a cautionary tale about the importance of ethical governance in aviation and the need for rigorous oversight to protect against fraud and misconduct, thereby preserving the integrity of both domestic and international markets.