Paragraph 1: Edo State’s Impressive Revenue Growth

The Edo State government has announced a remarkable surge in its internally generated revenue (IGR) for the first half of 2025. Between January and June, the state collected N52.6 billion, representing a substantial 46% increase compared to the N36.1 billion generated during the same period in 2024. This significant jump in revenue underscores the state’s commitment to fiscal responsibility and its success in broadening its tax base. The Edo Internal Revenue Service (EIRS), the agency responsible for tax collection, attributes this achievement to a combination of strategic initiatives, including capacity building for staff, enhanced stakeholder engagement, infrastructure upgrades, improved staff welfare, and stricter enforcement of tax laws.

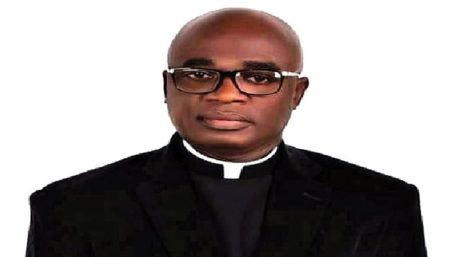

Paragraph 2: Focus on Efficiency and Compliance

Since assuming office in December 2024, the Executive Chairman of the EIRS, Oladele Bankole-Balogun, has prioritized enhancing the agency’s efficiency and strengthening tax compliance. Recognizing the vital role of a well-trained and motivated workforce, the EIRS has invested in capacity building for its staff, equipping them with the skills and knowledge necessary to effectively administer tax laws and optimize revenue collection. Furthermore, regular stakeholder engagements have fostered a collaborative approach to tax administration, ensuring transparency and building trust between the EIRS and the public. This collaborative environment has also facilitated the recovery of outstanding tax liabilities through cooperation with the judiciary.

Paragraph 3: Broadening the Tax Net and Civic Duty

While celebrating the impressive revenue growth, the EIRS emphasizes its ongoing commitment to widening the tax net and ensuring that all eligible taxpayers contribute their fair share. Bankole-Balogun stressed the importance of paying taxes as a civic duty, highlighting the direct link between tax revenue and the provision of essential public services. The EIRS has actively pursued strategies to bring more individuals and businesses into the tax system. During the first half of 2025, the agency successfully added 1,900 new taxpayers to its rolls, further solidifying the state’s revenue base. The EIRS also recognizes the dynamic nature of tax administration and the need for continuous improvement in its efforts to reach all eligible taxpayers.

Paragraph 4: Adapting to the Nigeria Tax Reform Law

The recent enactment of the Nigeria Tax Reform Law by President Bola Tinubu presents both opportunities and challenges for tax administration. The EIRS is committed to effectively implementing the provisions of the new law and ensuring that taxpayers are fully aware of the changes and their implications. The agency plans to intensify its public enlightenment efforts, providing clear and accessible information about the revised tax regulations. This proactive approach aims to minimize confusion and ensure a smooth transition to the new tax regime. The EIRS also anticipates that the new law will contribute to increased tax collection, particularly from high-income earners, who are expected to contribute more proportionally under the revised framework.

Paragraph 5: Leveraging Technology and Creativity for Improved Tax Collection

The EIRS recognizes the importance of leveraging technology and innovative strategies to optimize tax collection. Bankole-Balogun emphasized the agency’s intention to embrace technology to enhance its efficiency and effectiveness. By utilizing data analytics and other digital tools, the EIRS can better identify potential taxpayers, track compliance, and streamline tax administration processes. This commitment to technological advancement will complement the agency’s ongoing efforts to broaden the tax net and ensure that all eligible taxpayers contribute their fair share. The EIRS also believes that creative approaches to tax collection, such as targeted campaigns and incentives for early payment, can further boost revenue generation.

Paragraph 6: Building a Sustainable Edo State Through Tax Revenue

The EIRS views its work as essential to building a sustainable Edo State, where tax revenue is a driving force for development, and development, in turn, rewards taxpayers. The agency acknowledges that the road ahead may be challenging but remains resolute in its commitment to strengthening the tax system and ensuring its sustainability. The EIRS invites all stakeholders, including individuals, businesses, and civil society organizations, to join in the collective effort to build tax compliance and foster a culture of responsible tax payment. By working together, the people of Edo State can leverage tax revenue to fund essential public services, improve infrastructure, and create a more prosperous future for all.