Paragraph 1: Declining Foreign Investment in Nigerian Trade

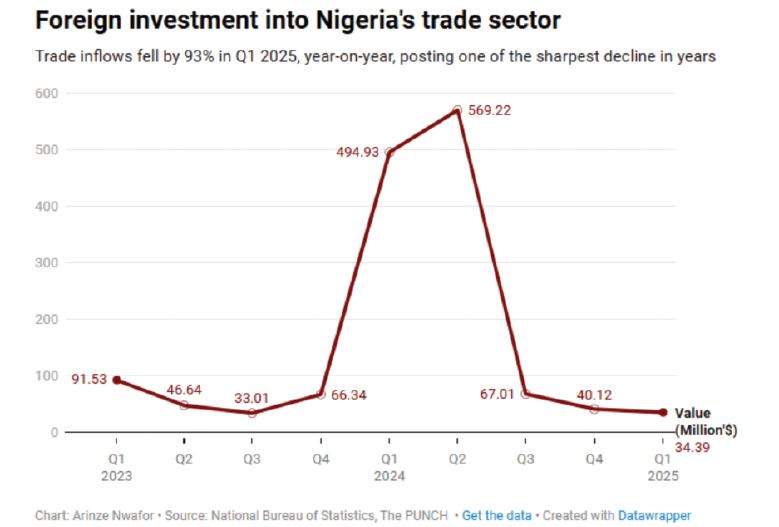

Nigeria’s trade sector is experiencing a significant downturn in foreign investment, marked by a 93% drop in capital importation during the first quarter of 2025 compared to the same period in 2024. This decline, amounting to a mere $34.39 million, represents a meager 0.61% of the total $5.64 billion in capital imported into the country during that period. This alarming trend, which began in the third quarter of 2024, raises concerns about the attractiveness of Nigeria’s trading sector to foreign investors.

Paragraph 2: Weakening Contribution of Trade to Nigerian Economy

The trade sector’s contribution to Nigeria’s GDP has also diminished, falling to 18.21% in the first quarter of 2025 from 18.45% in the same period of 2024. Furthermore, the sector’s growth rate slowed to 1.78% year-on-year in Q1 2025, a decrease from 2.31% in Q1 2024 and 2.04% in Q4 2024. This weakening performance, coupled with a 14.92% quarter-on-quarter contraction, signals a decreased appetite among foreign investors for Nigeria’s trading sector, traditionally dominated by foreign-owned retail chains and distributors.

Paragraph 3: Factors Driving the Decline in Foreign Investment

Several factors contribute to this decline, including macroeconomic headwinds such as inflation, exchange rate volatility, high import tariffs, and a government policy shift towards local sourcing. Inflation and fluctuating exchange rates have significantly impacted retail businesses reliant on imported goods. The increasing cost of imports has squeezed profit margins and discouraged foreign investors. Additionally, government policies promoting local production and consumption have further disincentivized foreign participation in the trade sector.

Paragraph 4: Impact on Foreign Retail Chains and Local Competition

The impact of these challenges is evident in the exit or downsizing of major foreign retail chains operating in Nigeria. Some companies have left the market entirely, while others have scaled down their operations due to currency issues and declining profitability. The rise of local competition also plays a role. Nigerian-owned supermarkets, offering comparable standards and competitive prices, have gained market share, reducing demand for products from larger foreign-owned malls.

Paragraph 5: Government Policy Shift and its Implications

The decline in trade inflows reflects a deliberate policy shift by the Nigerian government towards local production and reduced import dependence. This shift aims to stimulate domestic capacity and reduce reliance on foreign goods. However, analysts caution against a complete disengagement from foreign investment in the trade sector. While promoting local sourcing is crucial, maintaining a degree of foreign participation is important for maintaining standards, introducing new technologies, and integrating into global value chains.

Paragraph 6: Balancing Policy and Attracting Investment

A balanced approach is necessary to navigate the policy shift towards local sourcing while also fostering investor confidence. Controlling inflation, stabilizing exchange rates, and addressing logistical challenges are crucial for attracting renewed foreign investment. While the decline in trade inflows is partly due to policy changes, the overall increase in net capital importation suggests a reallocation of investments rather than a complete loss of confidence in the Nigerian economy. The key is to ensure that this reallocation strengthens Nigeria’s productive capacity, enhances local consumption, and boosts its competitiveness in the global market.