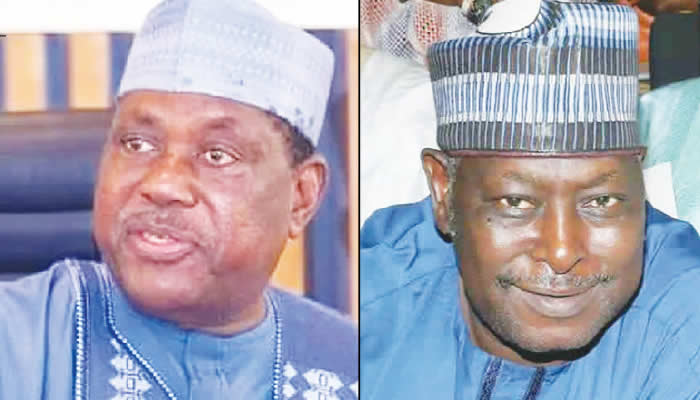

Babachir Lawal, a former Secretary to the Government of the Federation (SGF), has countered the incumbent SGF, George Akume’s assertion that the presidency should remain in the south until 2031. Lawal dismissed Akume’s statement as a personal opinion, reflecting his position within a “dysfunctional system,” and not representative of a broader consensus. This disagreement highlights the ongoing debate surrounding power rotation and regional representation in Nigerian politics, a sensitive issue that often fuels tensions between the North and South. Lawal’s criticism of Akume’s stance underscores the complexities of succession planning and the differing perspectives within the ruling political circles.

The heart of the contention lies in the proposed Tax Reform Bill, particularly the provisions concerning Value Added Tax (VAT) collection and distribution. Lawal vehemently opposes the bill, labeling it a “monster” that disadvantages the North. He argues that the South’s support for the bill stems from a “lazy mindset” and an unwarranted “hatred” for the North, fueled by accusations of Northerners being unproductive parasites. Lawal contends that this narrative ignores the North’s significant contribution to the nation’s economy, particularly in the agricultural sector, which provides raw materials for industries predominantly located in the South. This dispute over VAT revenue allocation reveals the deep-seated economic disparities and the contentious relationship between the two regions.

To substantiate his claims, Lawal uses his home state, Adamawa, as a case study. He highlights the substantial revenue potential of Adamawa’s livestock and agricultural production, citing the large volume of cattle sold and the significant tonnage of crops like rice, maize, beans, and sorghum cultivated in the state. He argues that the current VAT system unfairly attributes value-added to the southern states where these raw materials are processed, while the origin states like Adamawa receive little benefit. Lawal calculates that if Adamawa were to impose levies on these agricultural products, it could generate substantial revenue independently, exceeding the current VAT allocations.

Lawal emphasizes that Adamawa’s current reluctance to impose such levies stems from a desire to avoid double taxation and increased food prices, reflecting a compassionate leadership approach, unlike the perceived “mercantilism” of the Tinubu government. He underscores the irony of the South accusing the North of laziness while simultaneously benefiting from the North’s abundant raw materials. He challenges the notion of southern industrial productivity by questioning the viability of these industries without the North’s agricultural contributions. This argument seeks to reverse the narrative of Northern dependency and highlight the South’s reliance on Northern resources.

Lawal’s critique extends beyond the agricultural sector, pointing out that other northern products fuel Southern industries, from breweries to flour mills, with the South reaping the VAT benefits. He uses the example of Lagos State, questioning its economic viability without access to Northern raw materials, challenging the perception of Lagos as a self-sufficient economic powerhouse. This argument exposes the interconnectedness of the Nigerian economy and underscores the North’s crucial role in national economic stability.

In a provocative tone, Lawal warns of potential consequences if the current VAT system persists, hinting at possible increases in food prices and raw material costs. He links this potential economic hardship to the Tinubu administration’s policies on petroleum pricing and currency exchange, suggesting a broader criticism of the government’s economic management. This warning serves as a call for a more equitable and balanced approach to revenue allocation that recognizes the contributions of all regions, particularly the North. The underlying message is that the current system benefits the South at the expense of the North, creating an imbalance that could have dire economic consequences for the entire nation. Lawal’s stance presents a powerful argument for restructuring the VAT system to ensure fairer distribution of revenue and acknowledge the North’s vital contribution to the Nigerian economy.