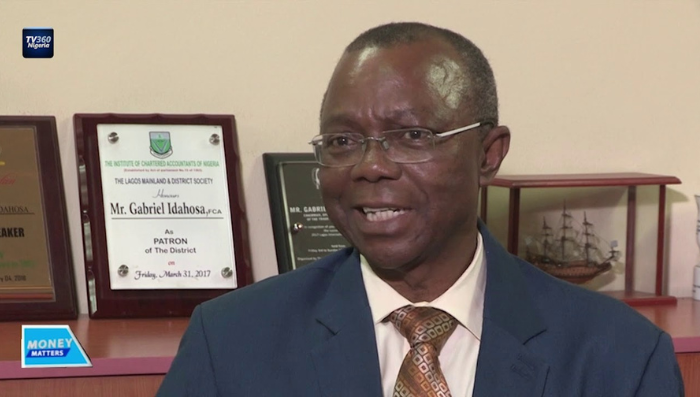

Paragraph 1: The Lagos Chamber of Commerce and Industry (LCCI) has voiced serious concerns regarding the Nigerian government’s proposed 2025 budget, particularly its ambitious capital expenditure plans. The LCCI President, Gabriel Idahosa, argues that the current fiscal framework is inadequate to fund the projected capital spending. While the N54.99 trillion budget appears large in naira terms, its dollar equivalent is significantly diminished due to the naira’s depreciation. This raises fundamental questions about the feasibility of implementing the planned capital projects. The core issue lies in the fact that the combined cost of debt servicing (N14.317 trillion) and recurrent expenditure (N13.64 trillion) surpasses the projected revenue, leaving no financial room for the N23.96 trillion allocated to capital expenditure. This essentially renders the capital expenditure plan unfunded under the current fiscal structure.

Paragraph 2: The LCCI’s warning underscores the critical imbalance in Nigeria’s budgetary allocations. The disproportionate share allocated to debt servicing and recurrent expenditure crowds out crucial investments in infrastructure and development initiatives. This imbalance, according to the LCCI, jeopardizes the country’s long-term development goals. The reliance on borrowing to finance the deficit, coupled with the escalating cost of debt servicing, creates a vicious cycle that further constrains the government’s ability to invest in critical areas. The LCCI emphasizes that this situation necessitates a fundamental shift in the government’s fiscal approach. Simply increasing the budget size without addressing the underlying structural issues will not resolve the funding gap for capital projects.

Paragraph 3: A key recommendation put forth by the LCCI is the need to attract private sector investment in strategic infrastructure projects. This, they argue, would not only alleviate the pressure on public finances but also improve Nigeria’s competitiveness. The chamber advocates for a Public-Private Partnership (PPP) model as a viable solution to bridge the infrastructure gap and stimulate economic growth. By leveraging private sector capital and expertise, the government can unlock significant investment in critical infrastructure projects, boosting economic activity and creating jobs. Furthermore, the LCCI stresses the importance of tying government borrowings strictly to productive projects that generate tangible economic returns. This would ensure that borrowed funds are utilized effectively and contribute to sustainable development.

Paragraph 4: The LCCI expresses concern about the nation’s escalating debt burden. Nigeria’s total public debt reached N144.67 trillion by December 2024, a substantial increase from N97.34 trillion the previous year. This figure is projected to rise further to over N157 trillion by the end of 2025 due to the planned N13 trillion borrowing to finance the budget deficit. The chamber cautions against excessive borrowing, particularly when it is not directed towards productive investments. The rising debt stock not only increases the burden of debt servicing but also potentially compromises future fiscal flexibility. The LCCI calls for a comprehensive review of the government’s debt management strategy, urging the exploration of cheaper financing options and more efficient utilization of national assets.

Paragraph 5: On the revenue generation front, the LCCI supports ongoing tax reforms but cautions against measures that could impose additional burdens on citizens. They advocate for a more efficient and equitable tax system that maximizes revenue collection without negatively impacting the populace. The chamber emphasizes that a well-designed tax system should incentivize economic activity and investment rather than stifle it. Balancing the need for increased revenue with the imperative to maintain a conducive business environment is crucial for sustainable economic growth. The LCCI’s stance highlights the need for a nuanced approach to tax reforms that considers the broader economic and social implications.

Paragraph 6: In summary, the LCCI’s critique of the 2025 budget highlights several critical challenges facing the Nigerian economy. The chamber calls for a holistic overhaul of the country’s fiscal approach, encompassing a more strategic allocation of resources, a greater focus on attracting private sector investment, and a prudent debt management strategy. Furthermore, the LCCI emphasizes the importance of policy consistency and building investor confidence to stimulate economic growth. By prioritizing productive investments, strengthening revenue generation mechanisms, and fostering a conducive business environment, Nigeria can unlock its economic potential and achieve sustainable development goals. The LCCI’s ongoing engagement with government agencies and stakeholders underscores its commitment to advocating for reforms that support both the private sector and national development.