Universal Insurance Plc, a prominent player in the Nigerian insurance industry, solidified its commitment to customer satisfaction by disbursing a substantial N3 billion in claims throughout the 2024 operating year. This significant payout underscores the company’s dedication to fulfilling its promises to policyholders, even amidst the prevailing economic challenges. The comprehensive claims settlement, covering various insurance policies from January to December 2024, served as a testament to the company’s financial strength and operational efficiency. This proactive approach to claims management reinforces trust and confidence among customers, further strengthening Universal Insurance Plc’s position in the competitive insurance landscape.

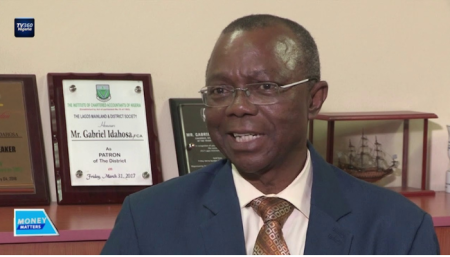

Dr. Jeff Duru, Managing Director/Chief Executive Officer of Universal Insurance Plc, emphasized the strategic importance of prioritizing customer needs. He articulated the company’s focus on bridging the insurance gap by offering accessible and innovative insurance products tailored for low-income earners and artisans. This inclusive strategy aims to empower individuals across various socio-economic strata, providing them with crucial financial protection against unforeseen events. By expanding its reach into the retail segment and catering to underserved populations, Universal Insurance Plc is playing a pivotal role in promoting financial inclusion and resilience within the Nigerian economy.

Beyond financial inclusivity, the company has heavily invested in technology to streamline its operations and enhance customer experience. A fully computerized system has been implemented to optimize service delivery, ensure prompt claims settlements, and foster a customer-centric approach. This digital transformation has empowered Universal Insurance Plc to efficiently manage large volumes of claims, maintain accurate records, and provide personalized services to its diverse customer base. The investment in technology not only enhances efficiency but also demonstrates the company’s commitment to adopting modern practices and staying ahead of the curve in the evolving insurance industry.

Central to Universal Insurance Plc’s service delivery model is its sophisticated claims management process. Leveraging a robust technological framework, the company has implemented a streamlined system that allows policyholders to report claims swiftly and conveniently from any location. This eliminates the need for physical visits to the company’s offices, saving customers valuable time and effort. The digital platform facilitates efficient communication, ensures transparency in the claims process, and enables quick disbursement of settlements, further enhancing customer satisfaction and trust.

Furthermore, Universal Insurance Plc places a strong emphasis on transparency and open communication with its customers. By providing clear and accessible information about the claims process, the company empowers policyholders to understand their rights and navigate the system with ease. This transparent approach fosters trust and strengthens the relationship between the company and its customers, establishing Universal Insurance Plc as a reliable and dependable partner in mitigating risks.

In conclusion, Universal Insurance Plc’s payment of N3 billion in claims during 2024 highlights its unwavering commitment to customer satisfaction, financial stability, and technological advancement. By focusing on inclusive insurance solutions, streamlining its operations through digital transformation, and prioritizing a customer-centric approach, the company has positioned itself as a leading force in the Nigerian insurance industry. The proactive claims management process, combined with a robust technological framework, ensures efficient and prompt settlement of claims, further solidifying Universal Insurance Plc’s reputation as a reliable and trusted partner for individuals and businesses seeking comprehensive insurance coverage. The company’s commitment to transparency and clear communication further strengthens its relationship with customers, reinforcing its position as a key player in promoting financial security and resilience within the Nigerian economy.