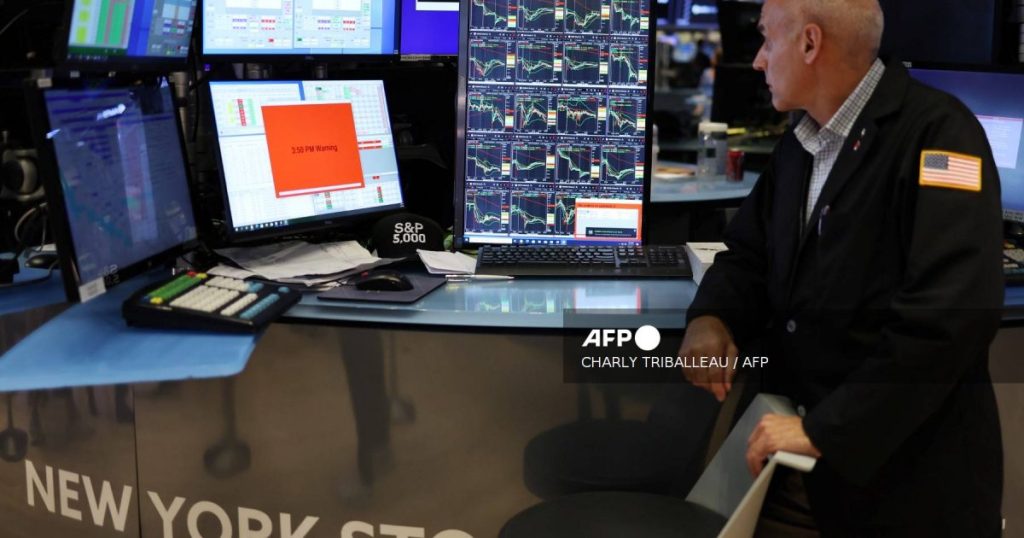

The opening bell on Wall Street Tuesday painted a picture of continued market anxiety, as major indexes struggled to recover from the previous day’s sharp declines. These declines were fueled by growing fears that President Trump’s aggressive trade policies, particularly the recently imposed tariffs on Canada, Mexico, and China, could inadvertently push the US economy into a recession. While the tech-heavy Nasdaq Composite Index managed a modest early gain, clawing back some of Monday’s substantial losses, both the broader S&P 500 and the Dow Jones Industrial Average slipped further into negative territory. This divergence highlighted the ongoing uncertainty and volatility gripping the market, with investors weighing the potential negative impact of trade disputes against other economic indicators.

The prevailing sentiment among market analysts was one of cautious pessimism. Experts suggested that the market lacked a clear catalyst to spark a sustained rebound. The escalating trade tensions, coupled with weakening economic data, created a challenging environment for investors. The imposition of tariffs on key trading partners raised concerns about retaliatory measures and a potential slowdown in global trade, which could ripple through the US economy. This unease was reflected in the comments of analysts, who emphasized the need for a positive trigger to shift market sentiment and spur renewed buying interest.

One potential catalyst, as identified by analysts, was the upcoming release of consumer inflation data. A sustained cooling of inflation could offer a glimmer of hope for the market, as it might influence the Federal Reserve’s monetary policy decisions. Lower inflation could provide the Fed with more leeway to cut interest rates further, potentially stimulating economic activity and boosting investor confidence. However, until such concrete positive data emerges, the market remained vulnerable to further declines, driven by the persistent anxieties surrounding trade and economic growth.

Adding to the prevailing gloom was new guidance from major airlines, which further underscored the potential economic headwinds. Delta Air Lines, a bellwether for the airline industry, lowered its earnings outlook, citing weaker demand. This move signaled a potential slowdown in consumer spending and business travel, both indicators of broader economic health. Delta’s share price suffered a significant drop in early trading, reflecting investor concerns about the company’s prospects and the broader implications for the travel and tourism sector.

The confluence of these factors – trade war anxieties, weakening economic data, and negative corporate guidance – painted a challenging picture for the US stock market. Investors remained on edge, seeking concrete evidence of a turnaround before committing to further investments. The market’s performance in the coming days would likely hinge on the upcoming inflation data and any further developments on the trade front. A sustained period of uncertainty and volatility seemed likely, as investors attempted to navigate the complex and evolving economic landscape.

In essence, the stock market’s early performance on Tuesday reflected a continuation of the previous day’s sell-off, driven by escalating trade tensions and growing concerns about a potential economic downturn. The lack of a clear catalyst for a rebound, coupled with negative news from the airline industry, further fueled investor anxiety. The upcoming inflation data held the potential to shift market sentiment, but until then, uncertainty and volatility were expected to persist, with investors closely monitoring economic indicators and any developments on the trade front. The interplay of these factors would ultimately determine the direction of the market in the short to medium term.